|

|

|

|

Archived Employment

Newsletter Analyses

(all past analyses are posted below starting in August 2006 are posted)

This is an edited collection of the introductory analyses

and commentaries from past

Monthly Employment Trends Newsletter that we internally refer to as the "Soapbox Statement." Although every

effort has been made to keep the links to outside sources / references current, some may have expired.

Take note that the figures presented may have been revised in subsequent data releases.

|

2022 |

|

February 2022

(posted

February 4, 2022)

return to top |

|

Con Te

Partiro...

Not to bury the lead, this is my last newsletter ... I'm retiring.

But, why use a few words, when many more will do?

In December 2002, I left Staffing Industry Analysts not necessarily to

strike out on my own, but to take a breather to see what else life had to

offer. Eventually, a few projects came in over the transom, I started this

newsletter, and eventually secured a few clients. The first edition of this

newsletter was published on

September 1, 2006, as I lamented that

Pluto had been demoted from planet status by a consensus of astronomers .

In that first newsletter, I drew a parallel to what could be considered

"normal job growth" and what to expect from the labor market should also

change, mainly due to a shift in population demographics.

So it's been almost 20

years and who is going to give me a gold watch? Honestly, who needs

one today and I have my father's a 25-year gold watch that he

received in 1967. I don't wear it but it still keeps excellent time

if I wind it, but I digress.

I am not participating

in what is currently being called the "Great Resignation" caused by

the pandemic because my decision was pretty much determined when I

was born. As I mentioned in that first newsletter there was massive

population shift expertly documented nearly two decades earlier by

U.S. Department of Labor’s Employment and Training Administration,

along with the Hudson Institute landmark study of the changing

American workforce "Workforce 2000: Work and Workers for the 21st

Century" published in 1987. A follow-up report "Workforce 2020

-- Work and Workers in the 21st Century" was published in 1997.

IMHO, the pandemic has been a catalyst to the evitable.

When predicting

workforce and labor trends in "Workforce 2000" for the following 15

years and presenting possible public policy issues that would arise,

the authors discussed, among other matters “…Improving the dynamism

of an aging workforce … Reconciling the needs of women, work, and

families … Integrating Blacks and Hispanics fully into the workforce

… Improving workers' education and skills.”

BTW, there is a recent

movement by some scientists arguing that Pluto should be

reclassified as a planet. What is old is again relevant in both

cosmology and labor market trends. Still don't accept this premise? Last

Friday Tears for Fears appeared on one of the late night talk shows

with their 1985 classic "Everybody Wants To Rule The World".

Apparently -- and I fact-checked this -- the original phrase was

"everybody wants to go to war".

Actually, I lied a

little -- I'll continue to look at economic and labor market trends

that interest me and will periodically publish those thoughts via

my

Twitter account.

Furthermore should an interesting

project/s -- preferably one-off or possibly ongoing -- come across a different transom since I now live in the

mountains of western North Carolina, I'll consider it.

As for my more

immediate plans,

time

to go hiking with the pup. time

to go hiking with the pup.

Bruce out.

[This space intentionally

left blank.] |

|

January 2022

(posted

February 4, 2022)

return to top |

|

Is there really a shortage of workers or workers who want to work

...

Granted, the above headline is a bit redundant, but this month's analysis could be a

different take on this subject that has not been widely reported. And this

part of the labor force is a meaningful portion of the temporary help

workforce, so this discussion could have important implications to the

staffing sector.

Labor force, a.k.a. workforce, data are normally reported as seasonally

adjusted numbers that take into account the -- well -- seasonally ups and

downs. But, not seasonally adjusted data are raw numbers and may

reveal more real ground level trends. Although the trendlines rarely run

differently between the seasonally and not seasonally adjust data, the

actual numbers differ. Not seasonally adjusted data are examined for this

discussion.

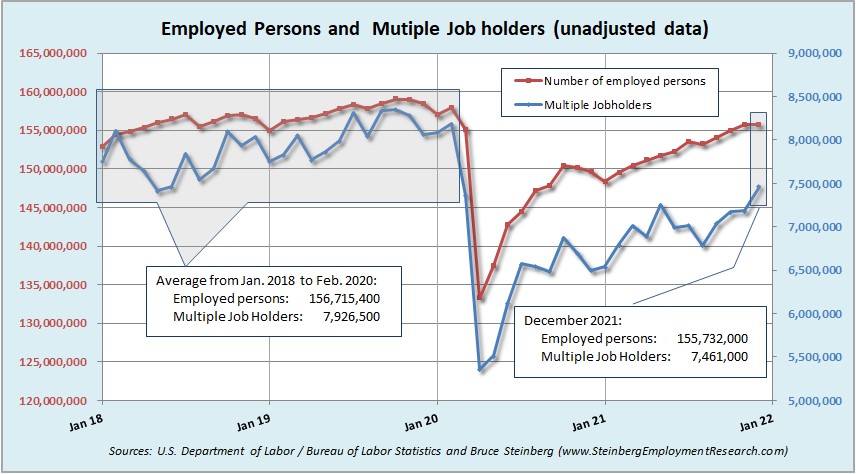

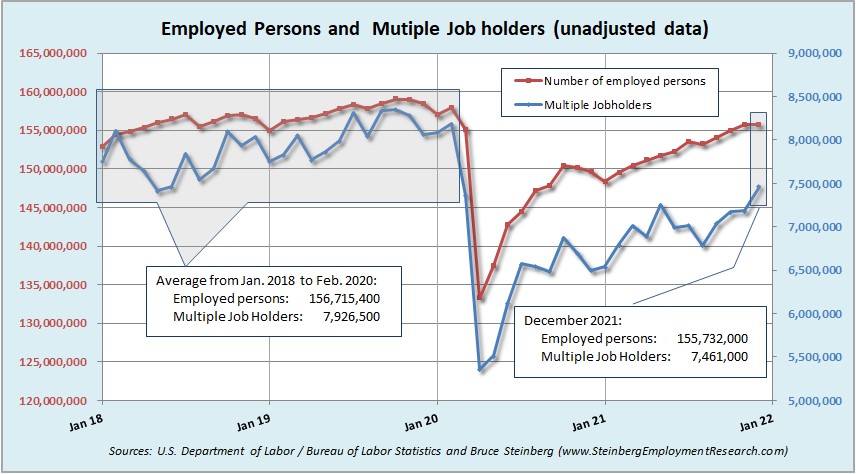

Although multiple job holders are not necessarily a very large part of the

total number of employed persons, they are not an insignificant portion at

around 5 percent -- and that ratio is less now than prior to the pandemic,

which brings us to the discussion at hand.

From January 201 to February 2020, before the pandemic started to affect

employment, multiple jobs holders were 5.1 percent of the total number of

employed persons. In April 2020, the first full month the pandemic affected

employment data, that ratio dropped to 4.0 percent and slowly began to rise to

4.8 percent by December 2021. (Because this analysis is prepared prior to the

release of the current employment situation, it lags by a

month.)

In raw numbers, the number of employed persons was only 983,400 less in

December 2021 than the average of the 26-month period prior to the pandemic.

For multiple job holders, there were 465,500 fewer in December 2021 than

prior to the pandemic.

Perhaps one of several reasons there are fewer multiple job holders and

hence people available for temporary help job openings could be because of

wage increases at the lower end may be outpacing inflation, at least for the

time being. Maybe those at the lower end of the wage scale do not find

it necessary or have sufficient incentive to work multiple jobs. There is no

single right answer or over encompassing reason covering all situations.

|

|

2021 |

|

December 2021

(posted

January 7, 2022)

return to top |

|

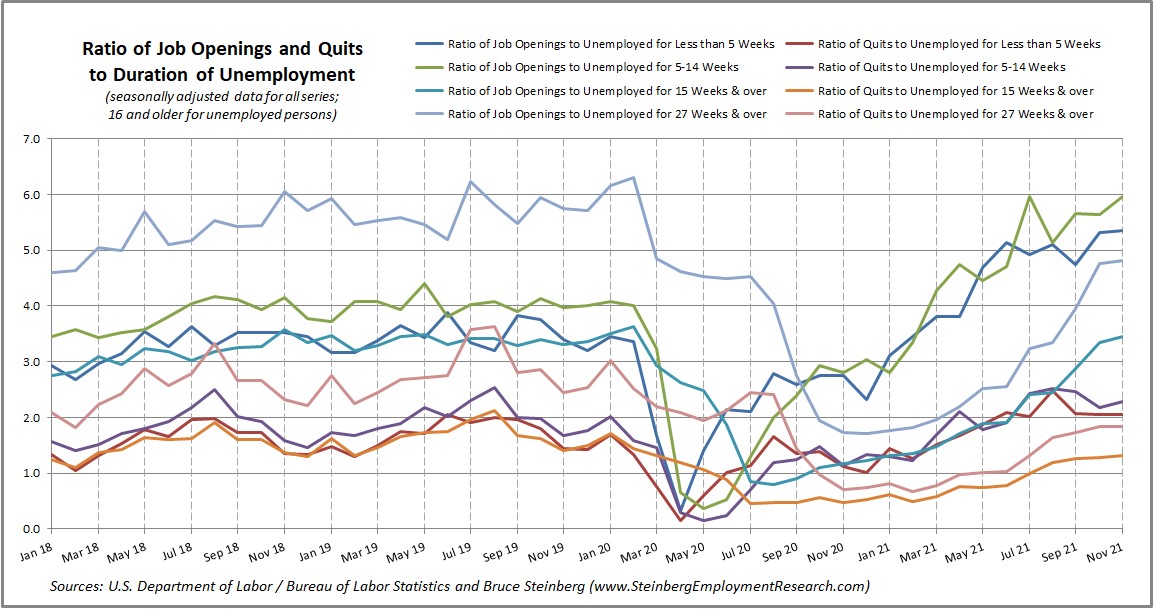

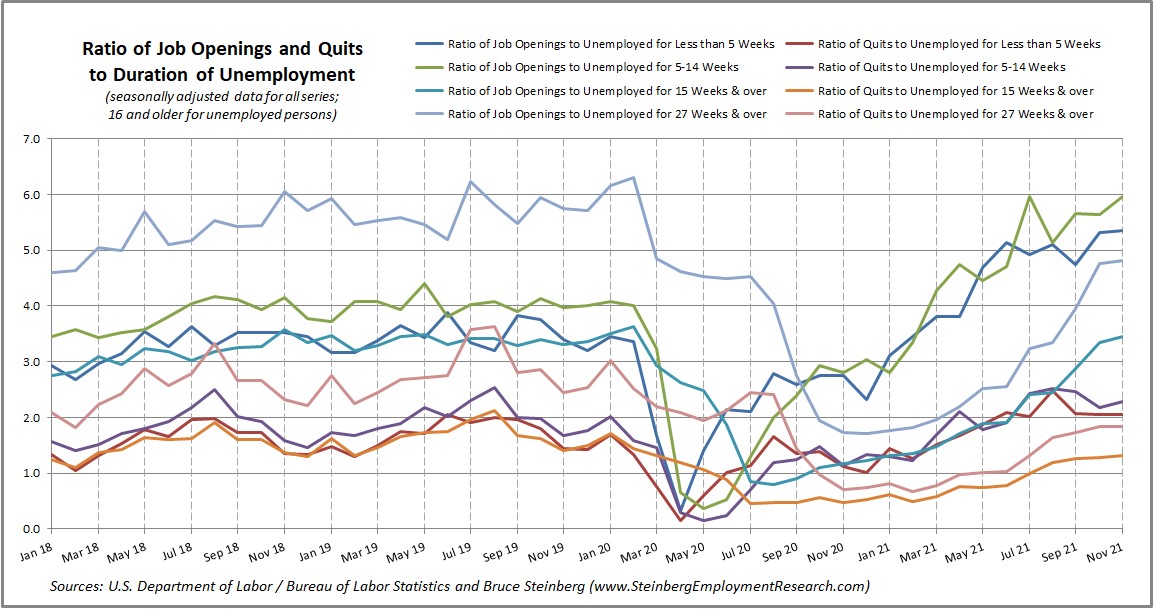

Dissecting a tangle of squiggly lines ...

This month we present data that -- technically speaking -- probably

shouldn't be combined. So shoot me. But, in our ignorance, we may have

stumbled across something that is very telling regarding the state of the

labor market.

This month we look at the ratio between

two different data programs / surveys that measure very different

aspects of the employment market that also use very different

methodologies. Although we are not quite doing something as bizarre

as comparing the price of tomatoes in Cleveland and the average

number of children in a London household, but using such divergence

data sources can be sketchy. And don't get us started on how wrong

it is to present a chart with so many squiggly lines to draw any

conclusions! It may be helpful to click on the chart to open a

larger of this chart to see a trend or two.

Now that we have taken the liberty of pointing out the error of our

ways, let's see how the labor market has improved since the depth of

the pandemic and possibly show where it is now but still not back to

where it was before the virus infected the economy.

The Job Openings and Quits data come from a survey of employers /

businesses. (It is published on a two-month lag that is why the

latest data is for November.) Job Openings are pretty much

self-explanatory. The Quits number, on the other hand, is a subset

of Separations and Quits can better be labeled as voluntary quits.

Quits are considered as an indication of labor market strength --

people voluntarily leave a job because that may have already have

another job waiting or feel the job market is strong enough that

they can quit and find another job within their own timetables.

The number of

unemployed persons come from a survey of households querying if

household members are available to work, want a job, and are

actively seeking one but have not been able to secure one.

And now we answer the question how the pandemic affected the ratio

between these two different data series.

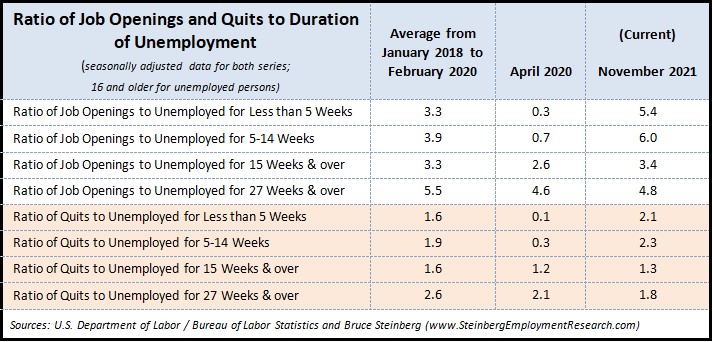

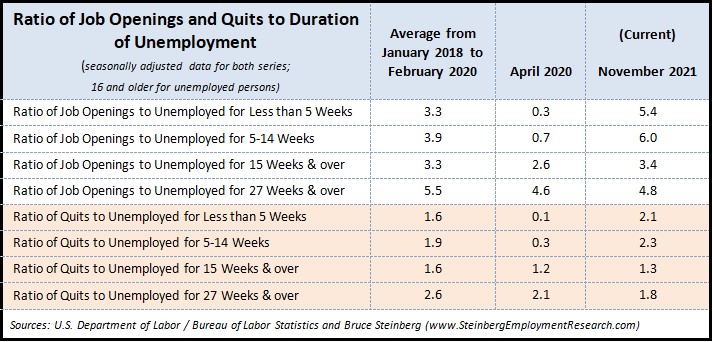

To help readers interpret the chart above, here are some actual

numbers: For those who where unemployed for less than five weeks in

January 2018 there were 2.9 jobs for each unemployed individual; by

April 2020, the first month that the pandemic impacted the

employment situation, that ratio fell to 0.32, or less than one job

for every unemployed person that skyrocketed that month. By November

2021, that ratio was 5.4, or 5.4 jobs for every single unemployed

person, that largest number since at least January 2018.

Quits performed similarly. For the same cohort -- those unemployed

for less than five weeks -- there were 1.3 quits for every

unemployed person in January 2018. In the pandemic bomb of April

2020 the ratio had sunk to 0.15 and by November 2021 it was 2.05, or

2.05 quits for every unemployed person.

Clearly there are more

openings and quits per unemployed person now as well as before the

pandemic, which we fairly arbitrarily define as the period from

January 2018 to February 2020, inclusive, for the cohort of those

unemployed for less than five weeks as well as the next group that

are those unemployed for five to 14 weeks. For those unemployed for

15 weeks and over, there were only slightly more job openings now

(3.4) than pre-pandemic (3.3).

But for those unemployed for a longer period of time -- 27 weeks and

longer -- the relationship reverses. There are fewer openings and

quits pre pandemic compared to November 2021 for these longer-term

unemployed people.

It is no great insight to conclude that the longer people are

unemployed, there are fewer jobs available to them, as well as fewer

quits, than for those who are unemployed for a shorter periods of

time. No surprise that the longer a person is unemployed, there are

fewer opportunities possibly because employers are less willing to

hire them because of a lack of skills, work history, and / or work

ethic.

Or in the words of one of the members of Team Steinberg who review

these opening analyses before publication, "An elegant proof of the

obvious."

|

|

November 2021

(posted

December 3, 2021)

return to top |

|

How

jobs have returned ... and how much further they

have to go to get back to where they were ...

We started this year with our

report of the December 2020 employment

situation looking at how some staffing-centric industries /

sectors have recovered -- or had started to recover -- from the

massive loss of jobs due to the pandemic. As we close out the

year, we thought another follow-up to these trends are in order.

Keep in mind that this section of our monthly employment report is

prepared prior to the publication of the November employment and

jobs data so this analysis runs to October.

[Note: depending upon how

well your browser and / or email program renders this chart, it may

be difficult to view; we suggest you click on it to open a larger

version.]

Total nonfarm jobs were down

only 2.9

percent from its peak but up 14.0 percent trough by October 2021. Private-sector jobs trended

similarly and 2.5 percent from its peak and up 16.7 percent from its

trough.

All but one of the limited sectors examined were still down in

October 2021 from their respective peaks of February 2020 sans one

-- computer systems design and related services is up 50,600 jobs,

or 2.3 percent.

Food services and drinking places were the hardest hit by the

pandemic in terms of the number of jobs that declined nearly fifty

percent from peak to trough and was still down 6.4

percent, or around 784,000 jobs, in October 2021 from its February

2020 peak but is up 82.0

percent from its April 2020 trough.

Clearly, temporary help services was hit very hard in April 2020

with a 33.9 percent decline from its peak two months earlier in

February 2020, and by October 2021 it was up 42.4 percent from its

April 2020 trough. But temporary help services was still down 5.9

percent in October 2021 from its February 2020 peak, so there

appears to still have some room to

grow.

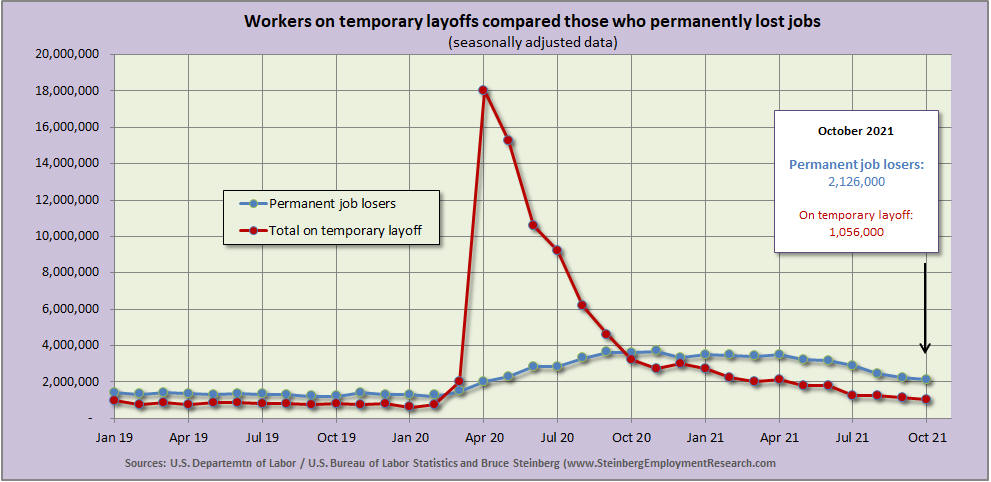

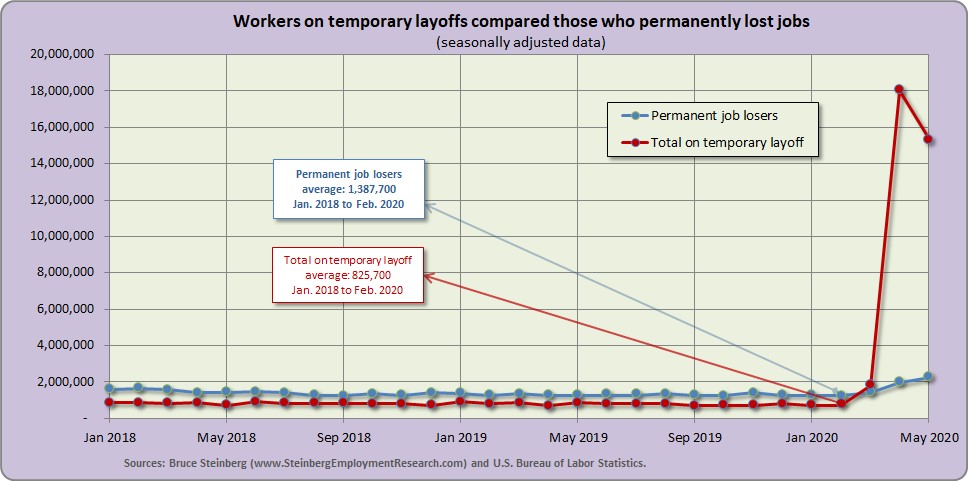

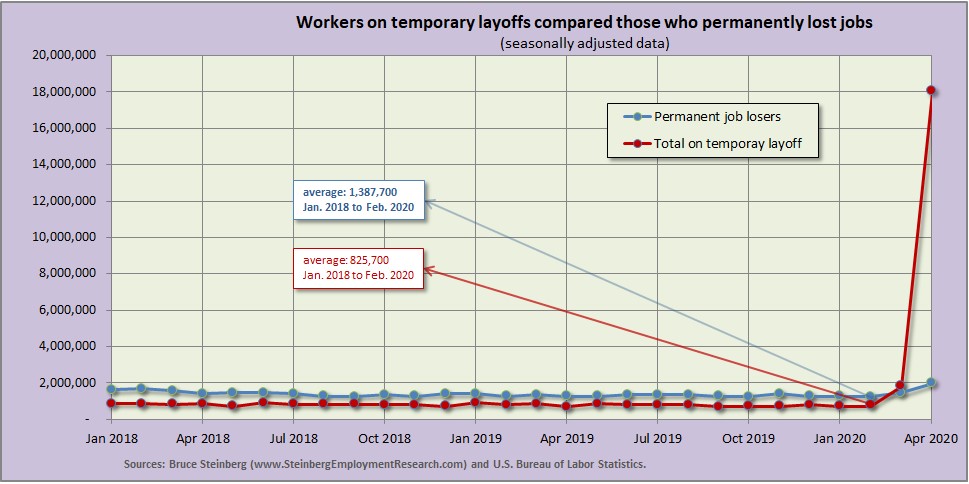

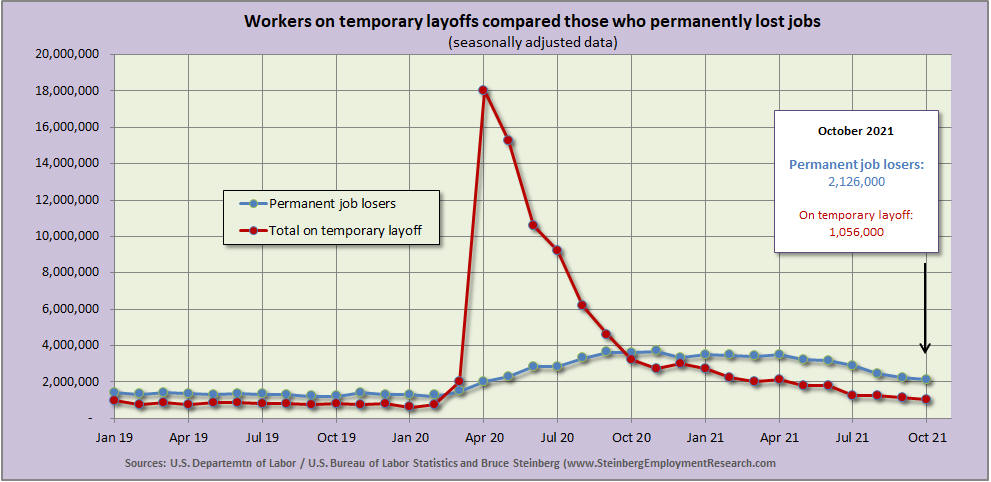

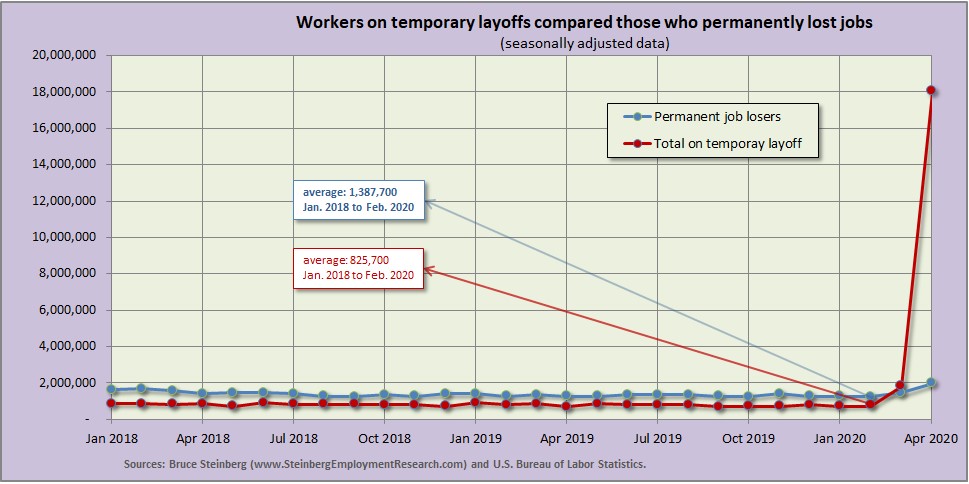

The number of workers on temporary layoffs

or permanently lost their jobs have still not returned to

pre-pandemic levels ...

Although the first affect of the pandemic on the employment and jobs

data may had first been seen in March 2020, the major impact did not occur until

the following month. This is because the survey week is mid-month.

Regardless, the pre-pandemic levels of these two metrics have pretty

much returned to their pre-pandemic relationship, but not levels.

For the past six months (May to October 2021), the average number of

workers on temporary layoffs was almost 1,384,000 and those who

report they permanently lost their jobs was just a little greater than

2,702,000. For the same six-month time period in pre-pandemic 2019,

just over 830,000 workers said they were on temporary layoff and

1,303,000 said they permanently lost their job.

Interestingly, the ratio between these two sets of workers -- and it

should point out that these statuses are self-reported so those who

report they were on temporary layoff may have, in reality, been

permanently laid off or vice-a-versa, which is why we used the words

"report" and "said" -- was 1.6 in 2019 meaning for every one workers

on temporary layoff, there were 1.6 who permanently lost their job;

By October 2021, the ratio had risen to 2.0. A

preliminary conclusion is that employers are lowering their

permanent staffing levels and the reasons for that development are

numerous -- more numerous than will be addressed here.

|

|

October 2021

(posted

November 5, 2021)

return to top |

|

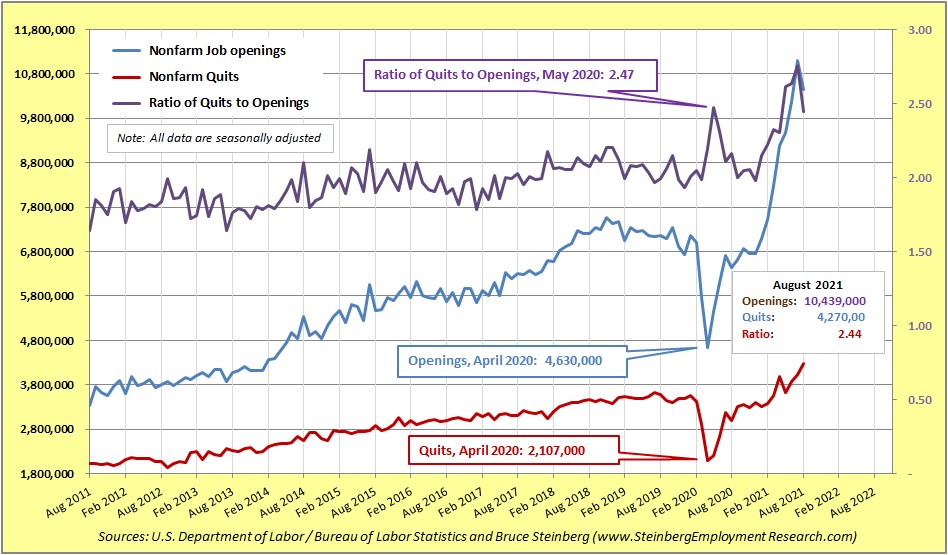

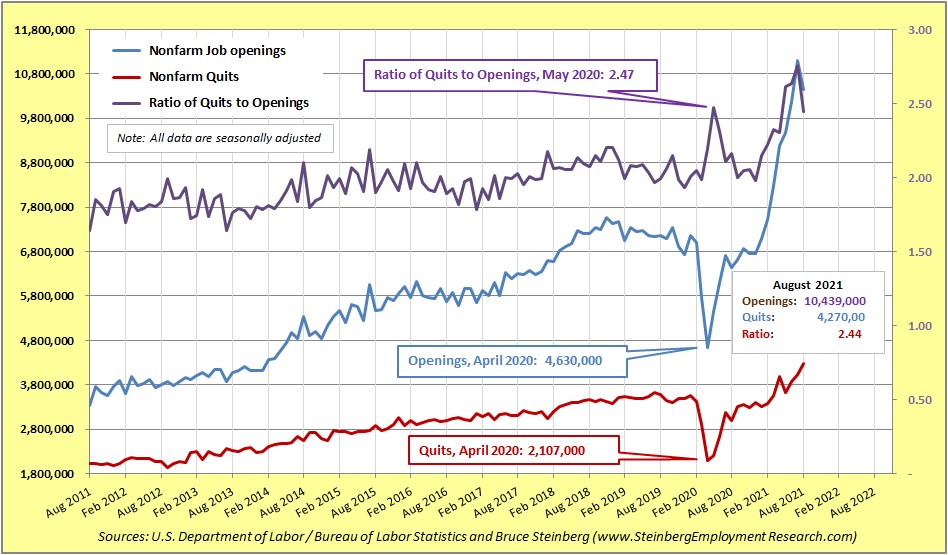

The Great Resignation continues -- or

does it and is it really something else?

Job openings

are self-explanatory, but quits may require some explanation.

Quits

are voluntary and many consider this metric as a sign of labor market

strength -- people quit their jobs when they optimistic about their

prospects for getting another job. The adverse is also true -- as

the number of job openings fall, people will hold on to their jobs

so there will be fewer quits. Both measurements tend to move in

unison. Quits

are voluntary and many consider this metric as a sign of labor market

strength -- people quit their jobs when they optimistic about their

prospects for getting another job. The adverse is also true -- as

the number of job openings fall, people will hold on to their jobs

so there will be fewer quits. Both measurements tend to move in

unison.

Obviously as the pandemic hit the employment market in April 2020

when job openings dried up, workers did not quit their jobs because

there were no other jobs to go to. (It's interesting to note that the number of job

openings was fairly steady from around mid-2015 to mid-2017, but we

digress.)

As employers fail to fill their job openings, the number of openings

rise, which can easily be seen -- and dramatically -- starting in

December 2020. Although the movement with the number of quits is not

as sharp, the ratio between quits and openings is. Although the

changes with one month of data do not necessary mean a new trend, it

is interesting to note that in August 2021 (latest available data) as the number of quits continued to rise, the number of job

openings declined along with the ratio between those two

measurements. FYI, these data are from the U.S. Department of Labor

/ Bureau of Labor Statistics program JOLTS (Job Openings and Labor

Turnover Survey); for the full news release of the data, go

here.

Are employers giving up looking for workers to fill

their openings, actually filled some of their job openings, have

accelerated their automation / technology efforts to require fewer

workers, or have

workers who may have quit found more likeable / suitable employment?

The reality is most likely a combination of these reasons, with a

few more unstated.

When will job growth and people return to jobs according to

so-called normal trends? "A long time ago in a galaxy far, far

away" in our very first employment report of

August 2006, we offered a clue of

what "normal" job growth may realistically look like making reference to

two seminal studies, the

first published in the late 1980s and the follow-up ten years later. Six years

later in

October 2012, we again referred to

those studies how shifting demographics was creating and will

continue to cause a labor shortage.

The current pandemic pushed a lot of people out of the workforce --

many of whom do not feel it is worth the personal capital to return

to a workplace. In the immortal words of Pogo, "We have met the

enemy and he is us." Incidentally, that phrase was coined as

an anti-pollution slogan for the first Earth Day in 1970. Guess

we've come full circle. Mic drop.

|

|

September 2021

(posted

October 8, 2021)

return to top |

|

And the results are ...

Last week, and several times this week, we surveyed our subscribers

asking if and how the ending of the enhanced unemployment benefits impacted

their staffing operations. Although we did not get the number of

responses we hoped for, there were enough to report them back

to you. And the comments we received were very enlightening. To

review the survey questions, go

here.

Geographically, there was a broad cross section across the country

with some responses reporting back at a local market, state, regional,

or

national levels, which made up just less than a quarter of the responses. And

more than 90 percent of the respondents knew when the enhanced

benefits ended, it is a bit disturbing that the remaining 9 percent

did not considering the business they are in.

As for the market segments of the responses, for which multiple

responses were accepted, it was pretty much all over the board, with

almost 75 percent in clerical / office, 50 percent in warehousing, about 45 percent in light industrial

and the same amount in customer service including call center -- all the rest of the categories were under

30 percent. Because of the small number of responses per market

area, it was not possible to draw even bad or inaccurate conclusions regarding

how ending enhanced U.I. benefits impacted any market or staffing

service segment.

Almost two-thirds did not see an increase in applicants or

inquires about available jobs, but 14 percent did and there were

three write-in votes: one for "Yes, but it was only temporary," one for

"Yes, but more of a trickle than a wave," and one for "We saw

more activity a few weeks before the benefits ended and ongoing."

When queried about what type of arrangements that new applicants or

inquiries were looking for, it was confirmed almost two-thirds percent of

the respondents did not see an appreciable increase in applicant or

inquiries. However, a solid third were interested in direct hire

opportunities, followed by temporary-to-hire at under 15 percent,

and about 10 percent looking for temporary jobs only. There was a

write in for "Remote" and another "Saw an increase, but not sure

tied to unemployment. They didn't care, they just wanted a job."

Although nearly 60 percent did not see an improvement in their fill rate after the

enhanced unemployment benefits ended, almost 30 percent did and a

bit less than 15 percent did not.

CONCLUSION: This survey is far from being a true reflection of

what did and continues to occur regarding this subject, but ending

enhanced unemployment benefits appears to have had a somewhat

positive affect on some

staffing businesses, albeit likely minor and highly dependent upon

geography and sector serviced.

However, as previously stated, the comments section of the survey -- as well as

comments received from those not directly involved in providing

staffing services but auxiliary services to the sector such as

consultants -- were quite illuminating. Here is some of the more

insightful feedback:

1) "... the combo of govt funding and covid caused a protracted

length of time in which folks found supplementary ways to create an

income. This, along with savings folks have accrued, will keep

people off the 'official' count till Jan of 2022." In other

words, people found alternative means of earning money.

2) "The sustain high unemployment is more likely to be accredited to

a skills gap, i.e. the jobs opening up first are a bad match for

those still unemployed because they either:

A) lack the skills required,

B) trained for a more highly skilled occupation and are,

wisely, continuing to look for jobs in their field, or

C) outside the regions where the jobs are appearing first."

3) Lack of child care due to lack of availability -- even in

good times, day care's economic viability can be frail at best.

Anecdotally, we have hear that "... many childcare facilities failed to

survive the pandemic. And with parents laid off or working from home,

these facilities lost significant revenues. In addition, until the

vaccines are approved for those under five many parents are refusing

to send their kids completely unprotected. It's not the facilities

they don't trust; it's the good sense of other parents."

4) Although there certainly are people "abusing the system" and

may be "addicted to 'eating from the government trough'." and

therefore find it easier to do that than get back to work. But it

should be pointed out that "gaming the system" exists at all strata of society but

in different and perhaps more sophisticated ways and is bipartisan

as well.

5) It comes as no great -- or even a minor -- revelation that

staffing services "... have more job orders than people to

fill them." But that same staffing executive goes on to say,

"However, companies that pay more do get their positions filled and

the turnover is less. It all comes down to pay. Companies that are

trying to hang on by paying $12.00 per hour are floundering. The

pendulum has swung to the advantage of the employee."

6) "The results are somewhat obscured by the COVID situation and

supply chain challenges partially offsetting the sun-setting on the

three UE extended and enhanced benefit programs."

It has been suggested that employment also did not recover quickly after

the influenza pandemic of 1918-1919 either. We looked into

this but could find no acceptable and / or verifiable data. First, the

pandemic coincided with the end of World War I; employment and

economic data was not very good at the time; and although the recession in

1920-21 did occur, that is best attributed to the actions of the

Federal Reserve at the time and not the pandemic.

For those who filled out the survey and provided their contact

information requesting the raw data, we will prepare and send that

out by early next week. We thank all for participating.

|

|

August 2021

(posted

September 3, 2021)

return to top |

|

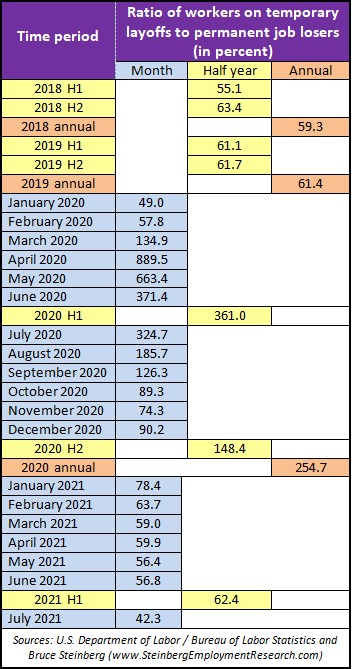

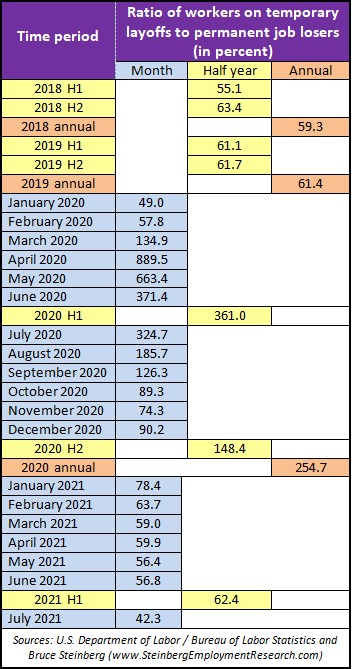

Another way to look at those who are on temporary layoffs compared

to permanent job losers ...

Several times during our pandemic-related analyses, we examined the different trends with those on temporary layoffs and those who permanently

lost their jobs. More importantly, how are they changing.

trends with those on temporary layoffs and those who permanently

lost their jobs. More importantly, how are they changing.

This month instead of emphasizing the actually numbers of workers in

each of these cohorts, we take a deeper dive into the ratio between

them expressed as a percentage. It may be helpful to review the

actual meaning of "percent" ... and we do not have to go any further

than reminding it is a ration of the "portion of one hundred."

Pre-pandemic the number of workers on temporary layoff was about 60

percent of those who permanently lost their jobs; in other words,

there were 60 workers on temporary layoff for every 100 who

permanently lost their jobs. Reduce it down and it works out to

three workers on temporary layoff for every five who lost their job

permanently.

During the initial impact of the pandemic on the employment economy,

the situation reversed -- and very abruptly and by a large amount.

In April 2020, there were almost 890 workers on temporary layoffs

for every 100 who permanently lost their jobs. Reduce and round it

down further, there were almost nine workers on temporary layoff for

every single worker who permanently lost a job.

As we have pointed out before, it is important to keep in mind

that these data are self-reported so it is not really known if people were really on temporary layoff or

it was just wishful thinking or employers were not being honest, or

possibly knowing, and

dangled the prospect that furloughed workers will be the first to be

rehired. In addition, the Paycheck Protection Program -- a.k.a. PPP

loans -- that subsidized firms to keep laid-off personnel on their

payrolls possibly encouraged some employers to report as

"temporarily" laid-off employees that realistically had no chance of

being brought back.

The ratio began to return to normal -- or the pre-pandemic

ratio -- this year and only slightly above the pre-pandemic level in

H1 2021 at 62.4 percent.

Much as been reported -- and essentially correctly -- that the

pandemic had a disproportionate impact on lower-wage, lower-skilled

service jobs and did not have such a large affect on higher-wage,

higher-skilled professional jobs.

But in July -- the latest figures available at this time -- the

ratio plunged to 42.3 percent. likely an indication that many of the

jobs that were lost to the pandemic are returning and remain in the

employment economy.

So

if many of the people who lost jobs during the pandemic are coming

back, why is the widespread labor shortage persisting? So

if many of the people who lost jobs during the pandemic are coming

back, why is the widespread labor shortage persisting?

Keep in mind that this information is just from people who lost jobs

-- and for those who are currently losing jobs, although there is a

declining number of than them, also feel that their personal job

loss is not temporary.

|

|

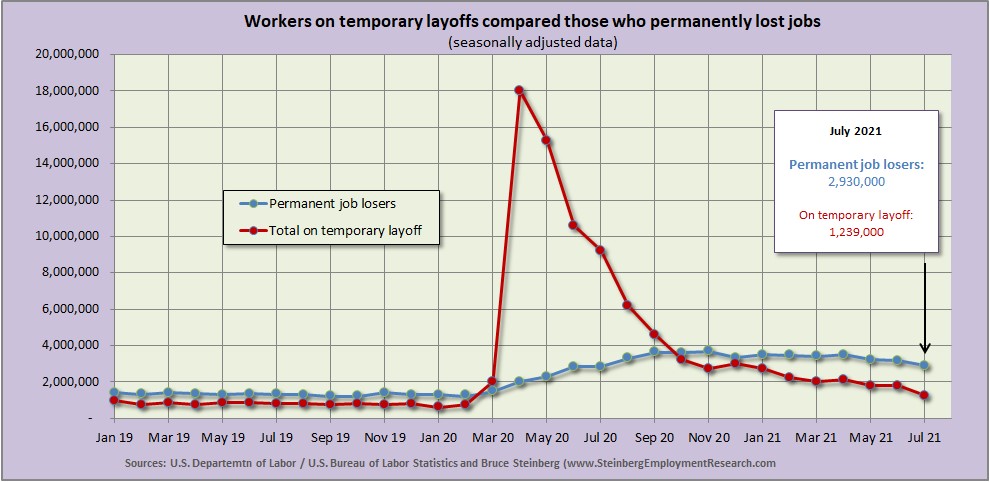

July 2021

(posted August 6, 2021)

return to top |

|

How

jobs have returned ... and how much further they need to go to

return to where they were ...

We started this year with our

report of the December 2020 employment

situation looking at

how some staffing-centric industries /

sectors have recovered by November -- or had started to recover -- from the

massive

loss of jobs due to the pandemic. It has been more than half a year

so we think it would be of interest to see how far jobs have come

back -- and possibly how far they still have to travel to get back

to pre-pandemic levels.

[note: depending upon how

your browser and / or email program renders the above chart, it may

be difficult to view; we suggest you click on it to open a larger

version.]

Total nonfarm jobs dropped

14.7 percent to its trough in April 2020 from its peak two months

earlier and was still down 4.4 percent from its peak but up 12.0

percent from its trough in June 2021. Private-sector jobs trended

similarly but were down further -- declined 16.5 percent -- into its

trough and rebounded higher -- up 14.4 percent. Interestingly,

both were up 4.4 percent in June 2021 from their peaks.

We won't go through each of

the sectors or subsectors that are presented in the table -- you can

see that for yourselves -- but will highlight some

specifics for the outliers to the overall job trends.

All but one of the sectors examined were still down in June 2021

from their respective peaks of February 2020 sans one -- computer

systems design and related services was essentially able to return

to its February 2020 level with a marginal gain of 2,700 jobs or 0.1

percent growth.

Food services and drinking places were the hardest hit by the

pandemic in terms of the number of jobs and was still down 10.3

percent in June 2021 from its February 2020 peak but is up 74.3

percent from its April 2020 trough.

Clearly, temporary help services was hit very hard in April 2020

with a 33.9 percent decline from its peak two months earlier in

February 2020, and by June 2021 it was up 33.7 percent from its

April 2020 trough. But temporary help services was still down 8.5

percent in June 2021 from its February 2020 peak, so there appears

to still have plenty of room to grow.

The employment situation

continues to be on the mends, but further upside movement appears to

be mainly limited by a lack of workers. If you find this information

interesting and helpful and would like to see similar data for other

industries / sectors,

let us know and we may just

address it in the future.

|

|

June 2021

(posted July 2, 2021)

return to top |

|

Are jobs and employment going sideways ... or just returning to

"normal"?

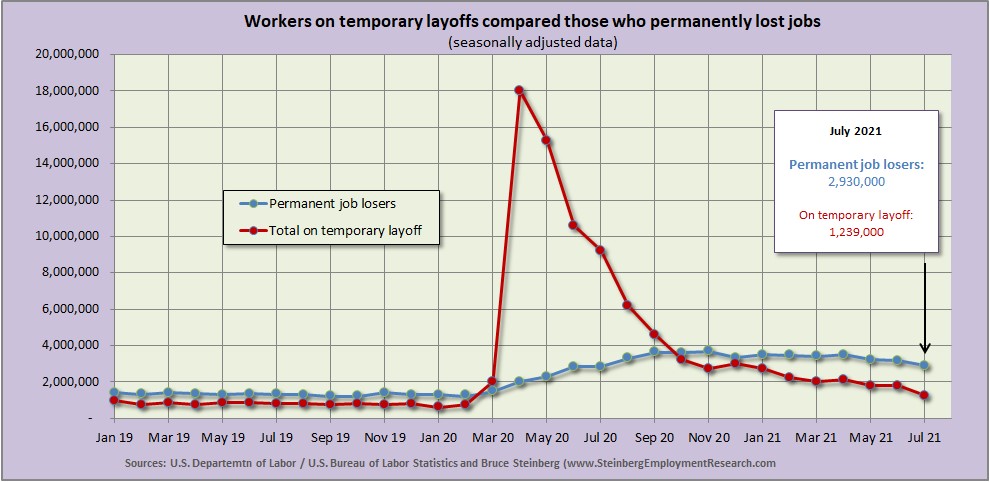

Several times last year during the pandemic -- the last time was

with the August 2020 employment report -- we looked the different

trends with those on temporary layoffs and those who permanently

lost their jobs.

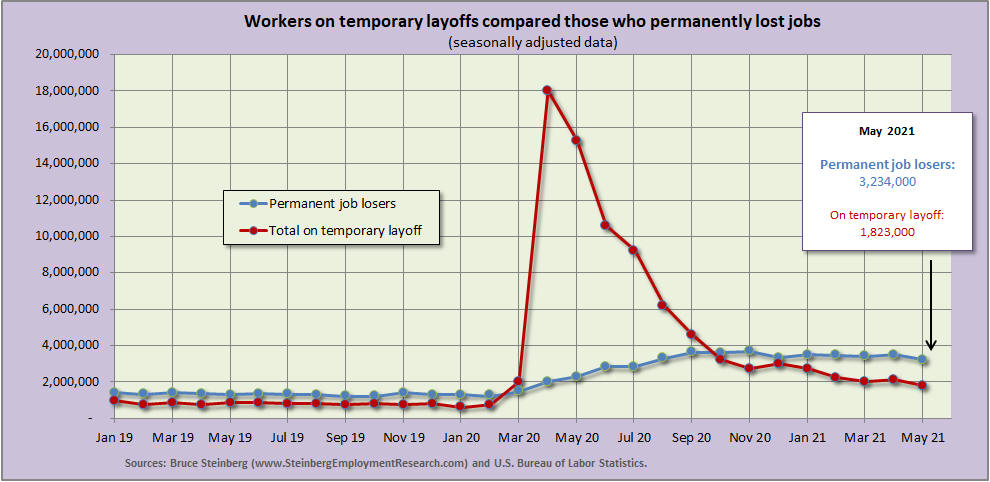

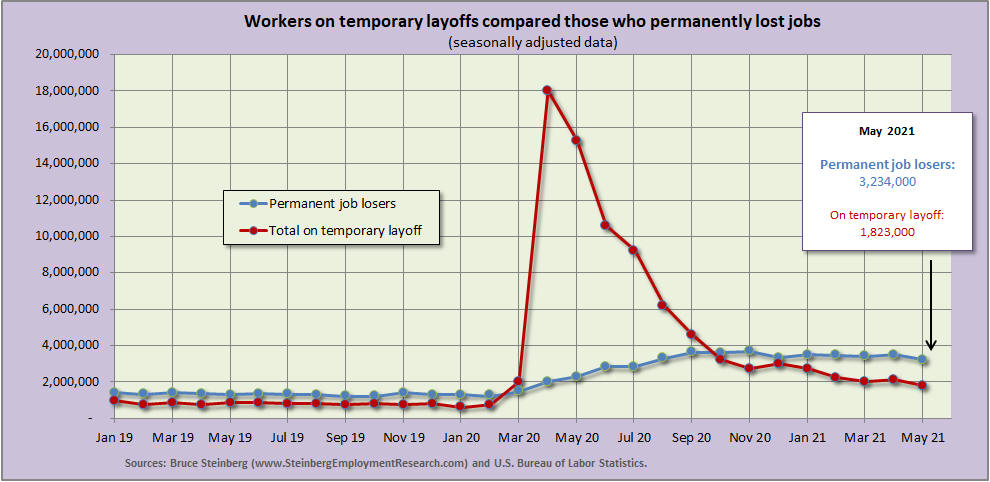

Regardless, those on temporary layoffs clearly skyrocketed at the

onset of the pandemic and remained at a much higher level then

pre-pandemic. Although the level has come down rapidly, it is still

higher. The average number on temporary layoff per month from

January 2019 to February 2020 was just under 805,000 before

radically rising and then dropping; by May 2021, it was to a little

more than 1,800,000, which is the first time it was under 2,000,000 since the

pandemic.

For those who have permanently lost their jobs, the pre-pandemic

level was just under 1,340,000 and gradually rose, albeit not as

dramatically, during the pandemic and by May 2021 was a little

more than 3,230,000.

Stated another way, there was an average of 1.7 people who

permanently lost their job for each person on temporary layoff in

2019. By the height of pandemic-related job losses in April 2020,

the situation was reversed and there were 890 people on temporary

layoff for each person who permanently lost their job. Since that

apex, the ratio been declining and somewhat returned to the

pre-pandemic relationship (those who permanently lost jobs is

greater than those on temporary layoff) and ratio has pretty much

returned to the 2019 and earlier level. In March and April it was

1.7 and in May the ratio increased marginally to 1.8

people who permanently lost their job for each person on temporary

layoff in May.

It is important to keep in mind that these data are self-reported so

it is not really known if people were really on temporary layoff or

it was just wishful thinking or employers were not being frank and

dangled the prospect that furloughed workers will be the first to be

rehired. In addition, the Paycheck Protection Program -- a.k.a. PPP

loans -- that subsidized firms to keep laid-off personnel on their

payrolls possibly encouraged some employers to report as

"temporarily" laid-off employees that realistically had no chance of

being rehired.

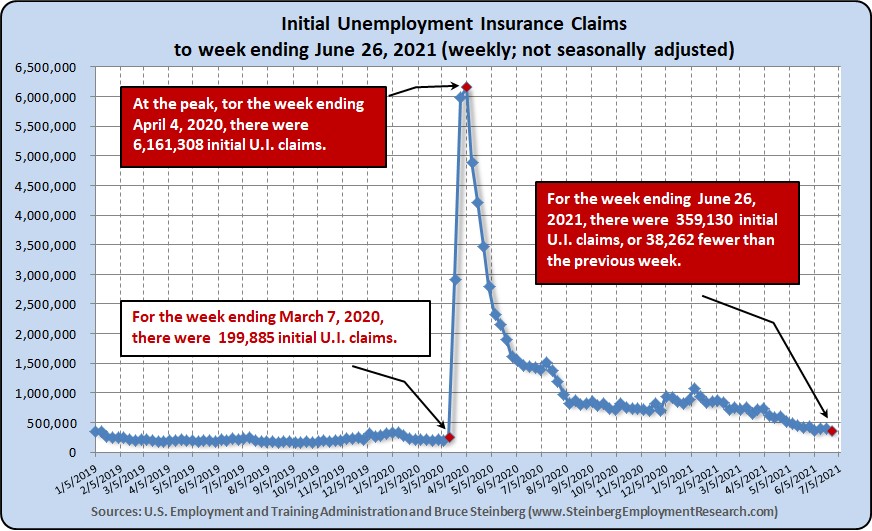

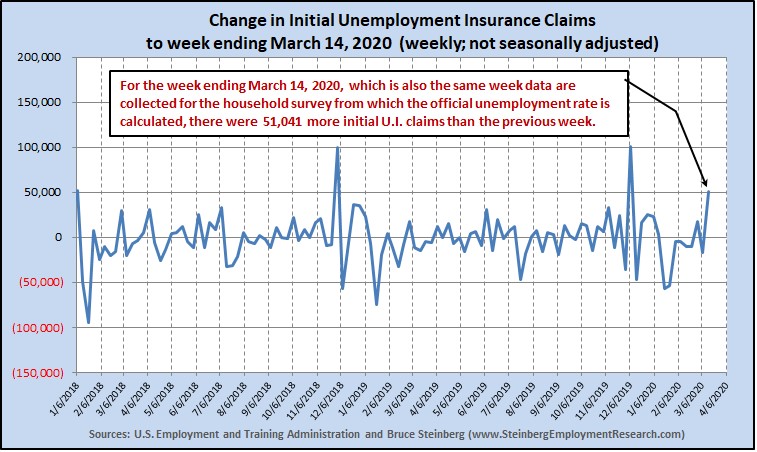

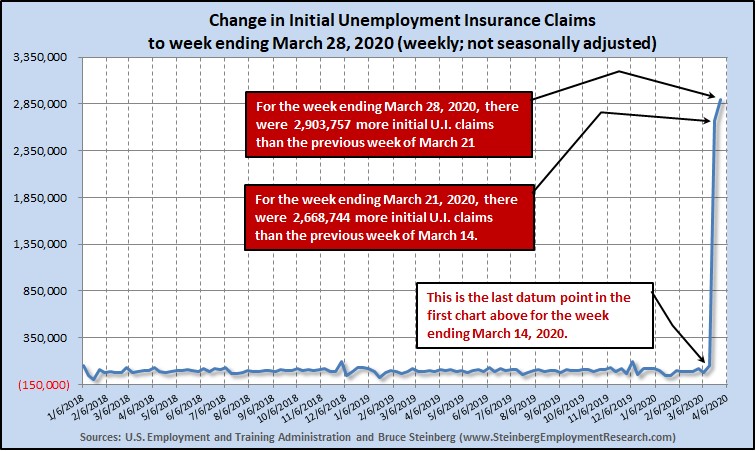

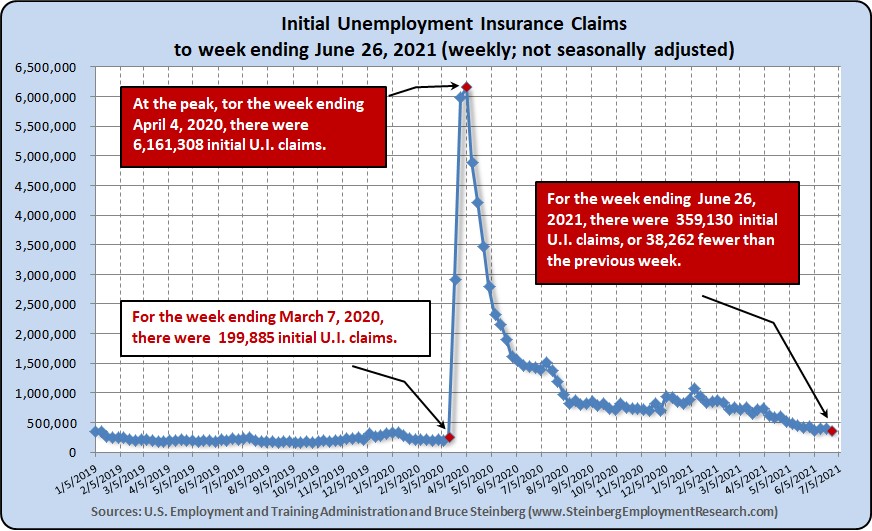

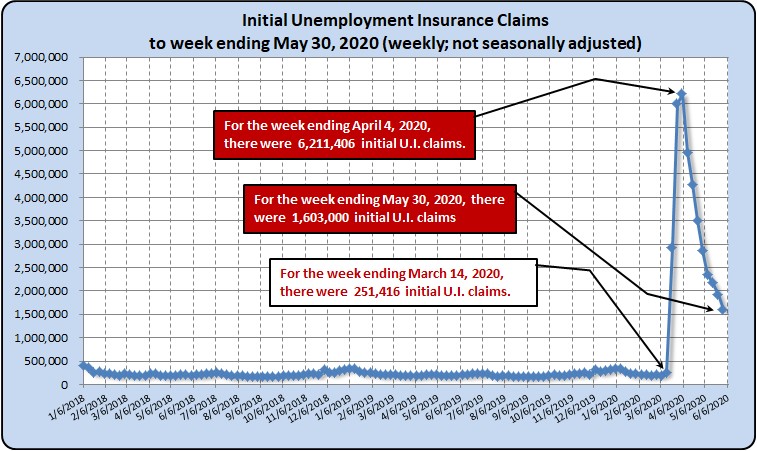

Initial unemployment claims still high but continue to

improve

...

The

latest Beige Book also discussed that the rich unemployment

benefits appear to be keeping workers from going back to work. A

typical comment: "... generous unemployment benefits had made it

difficult to bring payrolls back to desired levels, especially at

the entry level."

The number of initial unemployment claims continued to declined last week

by slightly more than 3.5 times the decline of the previous week. BTW, the Labor Deportment changed the

seasonally adjustment methodology because of the pandemic, which is

why we report the not seasonally adjusted data for

this series.

And now, a not rocket-science conclusion:

To state the obvious, these two charts look very similar. Fewer

people on either temporary layoff or permanently lost their jobs

tracks similar to the trends with the number of people filing

initial unemployment insurance claims, but still at greater levels

than before the pandemic.

|

|

May 2021

(posted June 4, 2021)

return to top |

|

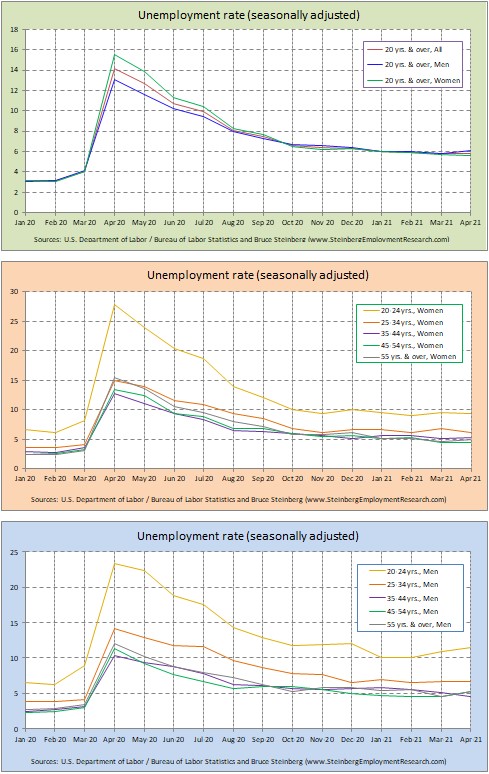

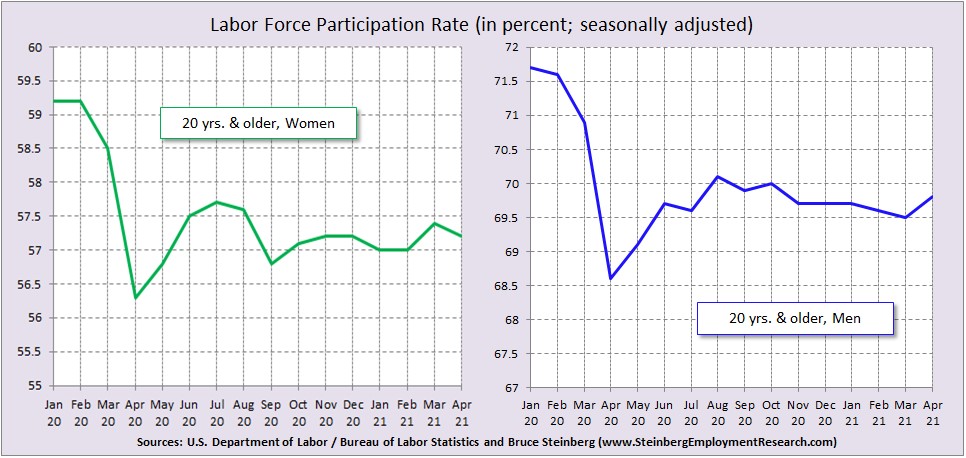

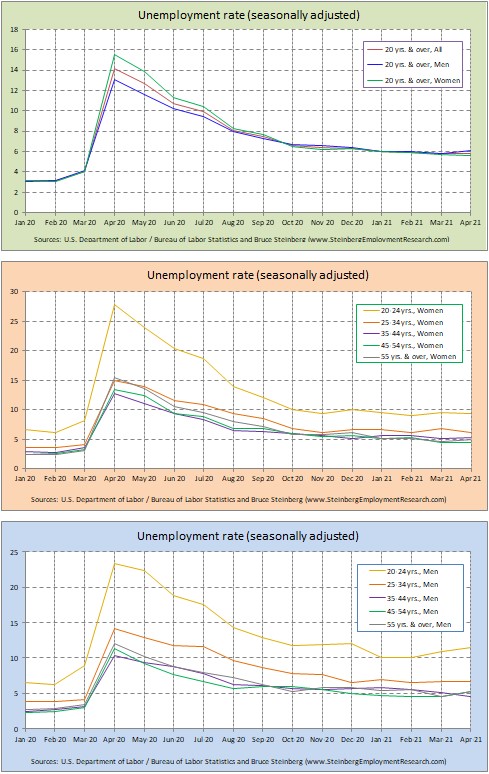

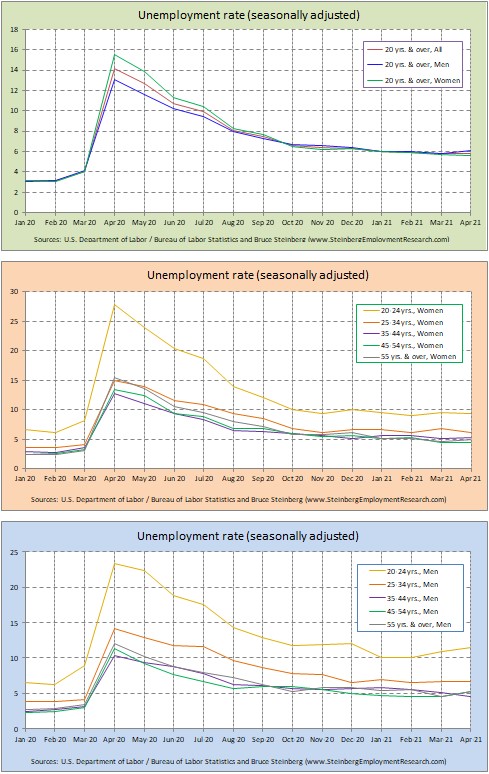

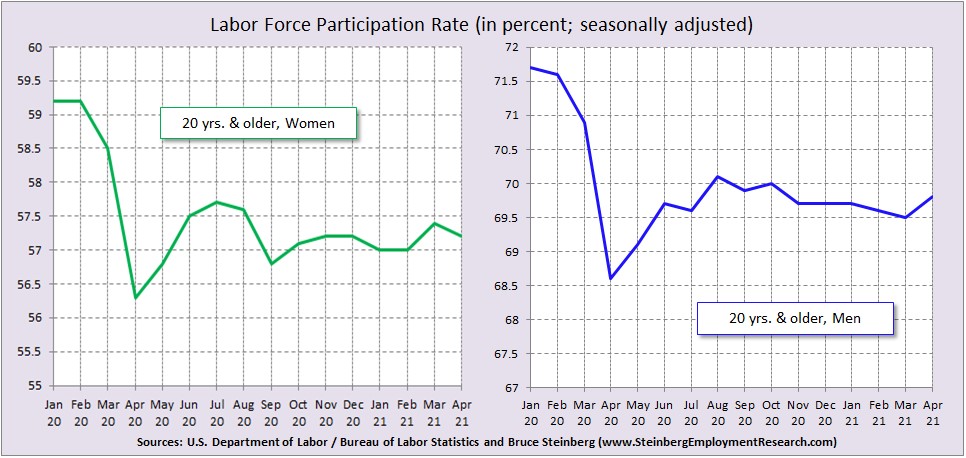

The recovery -- by gender ...

Last month when the unemployment rate ticked

up in April financial experts said it was because unemployment compensation was

keeping potential workers home because they could do better by not

working. This comment was reinforced by many of our staffing

executive readers lamenting that they just cannot get people to take

assignments.

But things are rarely a single monolith and another

contributing reason for the rise in the April unemployment rate. The

Federal Reserve Board heard from many employers regarding what's

keeping people out of the labor force. One comment of several

in its

latest Beige Book that was published earlier this week,

"... of factors limiting labor supply, including health safety

concerns, childcare challenges, cutbacks in public transportation

schedules, job search fatigue, and financial support from the

government."

While we examined unemployment by gender back in

November when reporting the October 2020 employment situation, we

thought it would be insightful to test this statement ... were women

staying out of the workforce more than men for whatever reason or

reasons? Child care appears to be a major concern and that often

falls upon women.

In reality, the unemployment rate for all women 20

years and older ticked down to 5.6 percent while the unemployment

rate for the same age group of men rose from 5.8 percent in March to

6.1 percent in April.

And again, trends are not monoliths. For women in the

younger age categories -- 20 to 24 and 25 to 34 -- the unemployment

rate declined, ticked up for the 35 to 44 year olds, was unchanged

for the 45 to 54 group, and rose for the 55 and older.

But for men, it rose significantly from March to

April from 10.9 percent to 11.5 percent, was unchanged for the 25 to

34 group, declined for the 35 to 44 year olds, and rose for those 45

and older.

However, the labor force participation rate for this

same group of those 20 and older did shift. For women, it

declined from 57.4 in March to 57.2 in April and a decline of

83,000 employed women. For men, the labor work participation rate rose

from 69.5 in March to 69.8 in April and an increase of 154,000 men.

Although the unemployment rate for women 20 years old

and older declined in April from the previous month, so did the

actual number of employed women. Conversely, the unemployment rate

for men in that same age group increased, so did the actual number

of employed men. Before your head explodes trying to figure out why

the overall unemployment rate increased, let's just say that there

is a major labor storage thought many sectors of the employment

economy.

That translates into major pain for the staffing

sector, or in the words of at least one staffing executive, "... we

have a zillion open job orders and no one to fill them."

But is the demand as over-the-top as it may appear via staffing

services' unfilled orders? Again referring to a comment -- which was

echoed by shortage in the supply chain for goods in

this week's Beige Book, "..

perceived demand may be overstated by clients placing orders with

more staffing firms than is typical."

|

|

April 2021

(posted May 7, 2021)

return to top |

|

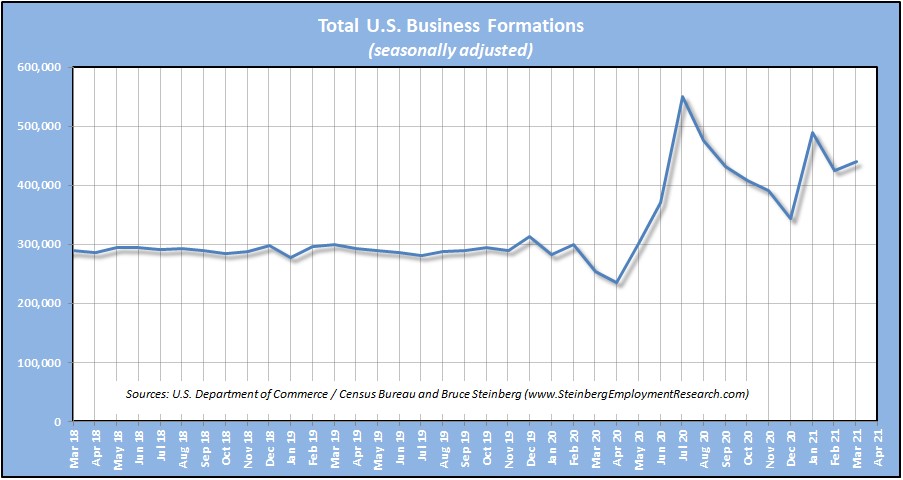

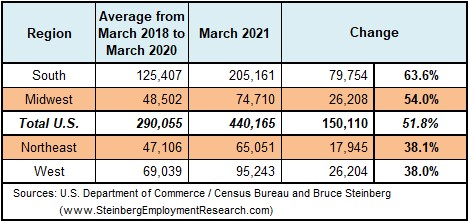

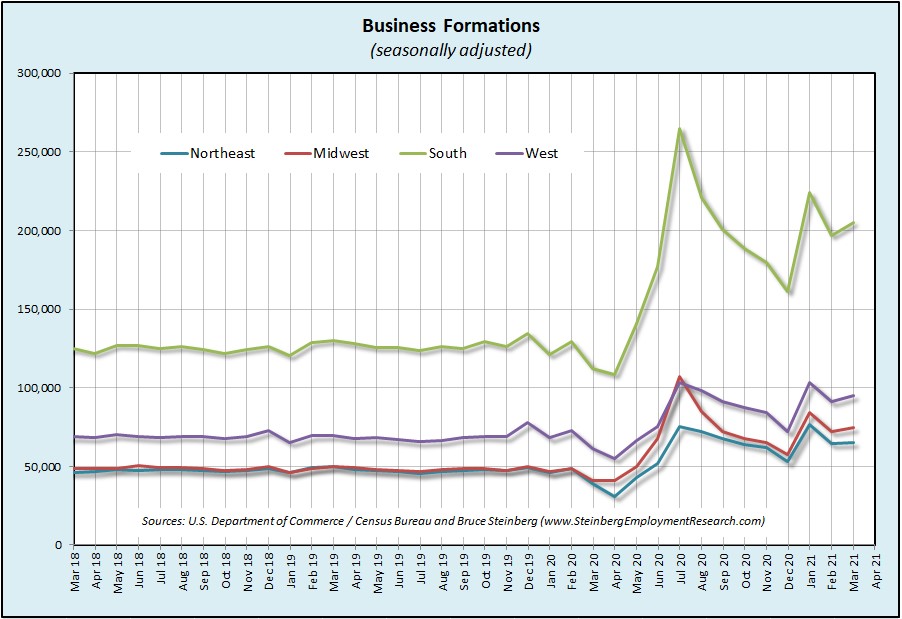

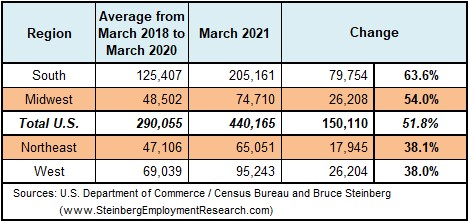

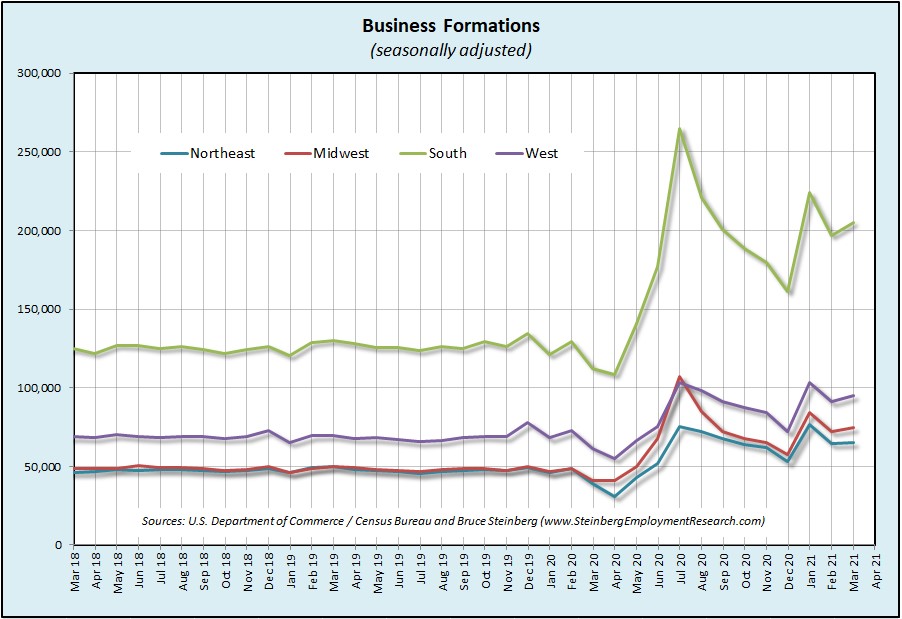

Are you in the right markets?

Last

month we examined how the trends with new business formations could provide some

strategic intel (it may not be an acceptable Scrabble word but this

is business, not a word game) for staffing

companies to target their marketing efforts by sector. This month we

examine the same information, but at the geographical level. Last

month we examined how the trends with new business formations could provide some

strategic intel (it may not be an acceptable Scrabble word but this

is business, not a word game) for staffing

companies to target their marketing efforts by sector. This month we

examine the same information, but at the geographical level.

As the data clearly show, clearly new businesses are

being formed at a higher rate today than pre-pandemic. Specifically,

from March 2019 to March 2020 -- we will call this period

"pre-pandemic" -- there was an average of about 290,100 new businesses

forming every month in the country. But in March 2021, almost

440,200 new business were formed for

an increase of almost 52 percent from the pre-pandemic period.

But some regions of the country did better in terms

of growth rates. The Midwest outperformed the country, albeit only

slightly, with a growth rate of 54 percent in March 2021 from the

two- year

pre-pandemic average with about 26,210 more business formations in

March 2021. year

pre-pandemic average with about 26,210 more business formations in

March 2021.

The South seems to be the hot bed of new

business formations both in terms of

percent growth

and absolute numbers. The number of new business formations jumped

nearly 64 percent with about 79,750 new businesses formed in

March 2021 from the pre-pandemic period.

Coincidentally the two remaining regions of the

country experienced essentially the same 38 percent increase for new

business formations with the economically mature Northeast region only seeing about

17,940 new

businesses forming in March 2021 from the pre-pandemic period while the West had 26,200 more.

|

|

March 2021

(posted April 2, 2021)

return to top |

|

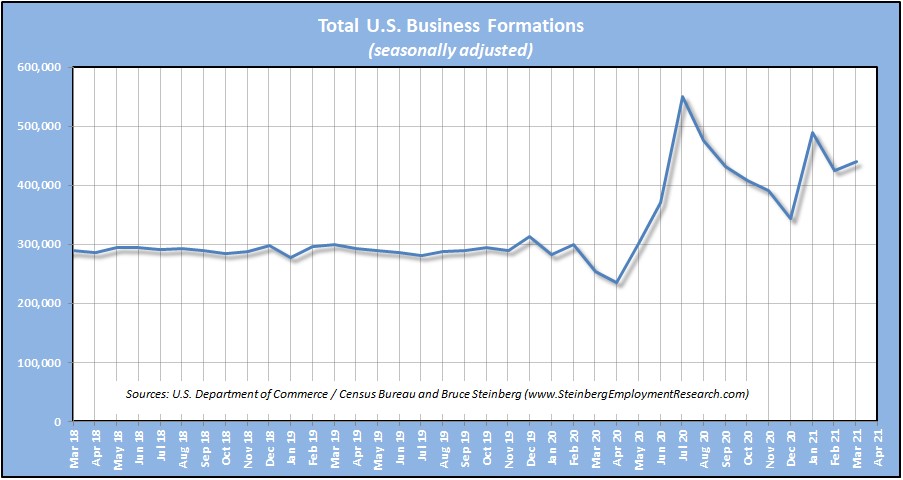

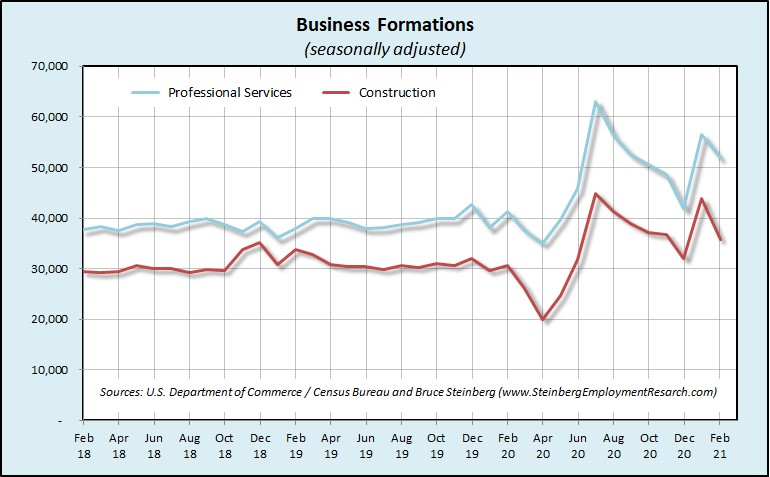

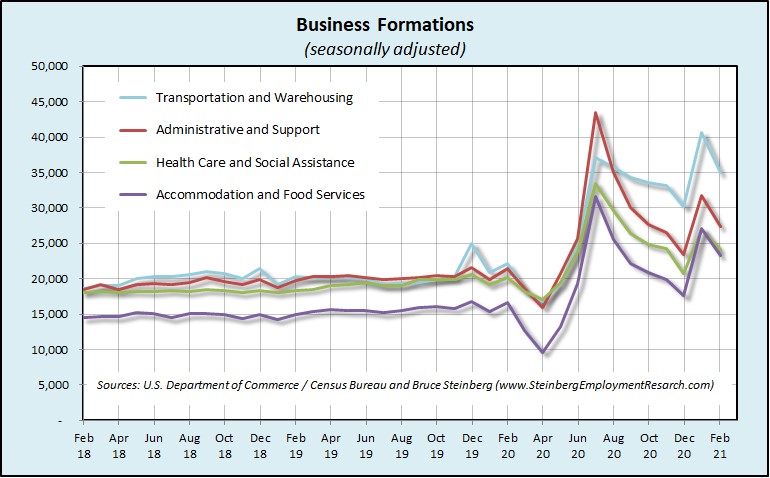

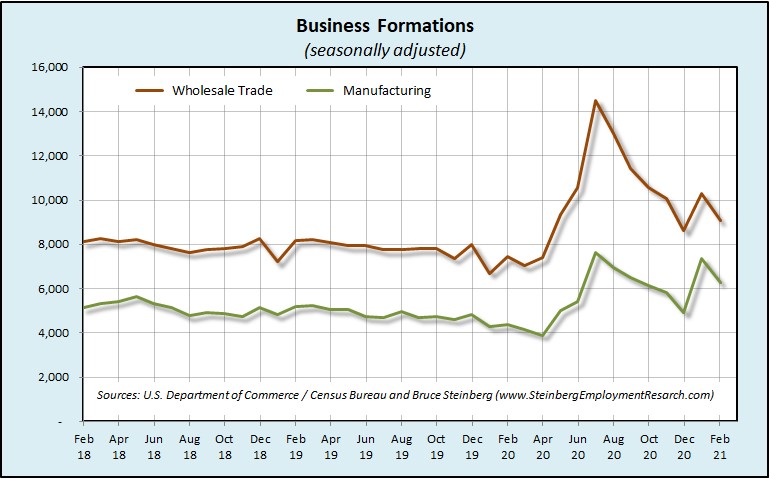

Are you targeting the right

sectors?

How

the pandemic has affected new business formation is another

interesting trend to examine. New businesses can often translate

into renewed opportunities for suppliers to those new businesses as

well as present more sales for staffing companies. How

the pandemic has affected new business formation is another

interesting trend to examine. New businesses can often translate

into renewed opportunities for suppliers to those new businesses as

well as present more sales for staffing companies.

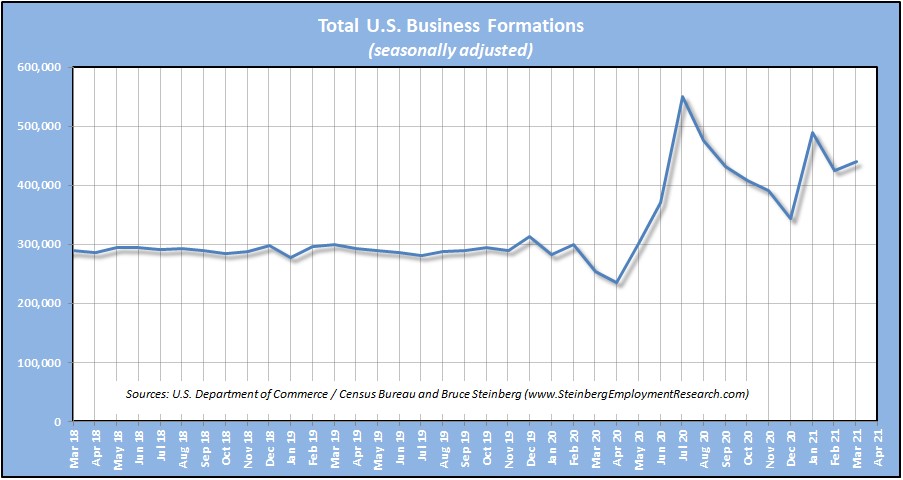

For two years prior to the pandemic, the average

number of business formations was just under 300,000 per month,

ranging from almost 17,600 more in February 2019 than the previous

month to just under 30,300 fewer in January 2020.

Between February 2018 and January 2020 inclusive

there were only a little less than 670 new

business formations per month on average.

But in April 2020, the month after

the pandemic was firmly established in the

United States, there were almost 61,900 fewer

new business formations

compared to just two months

earlier in

.February 2020. From that nadir in

April 2020 of only 236,500 new formations, it

jumped only three months later to a zenith of 551,660 in July 2020

to a zenith. 61,900 fewer

new business formations

compared to just two months

earlier in

.February 2020. From that nadir in

April 2020 of only 236,500 new formations, it

jumped only three months later to a zenith of 551,660 in July 2020

to a zenith.

And although the month-over-month changes

continue to bounce around a lot, from May 2020 to February

2021 inclusive, there was an average of almost 418,800 new business

formations per month.

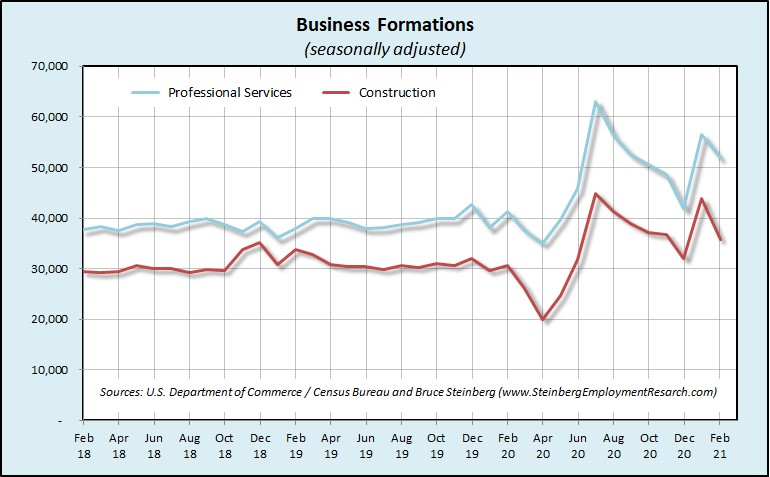

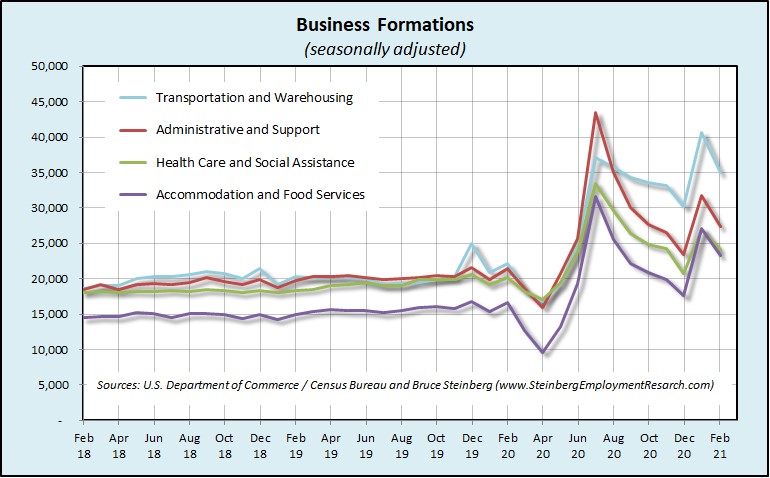

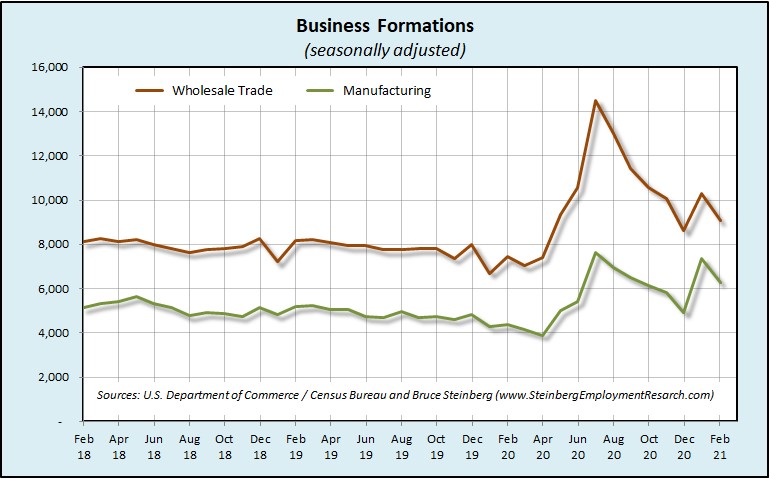

The same basic trend of reaching a low point in

April 2020, shooting up in July 2020, and then bouncing around a lot

but generally declining but still at a higher level in February 2021

than the two-year pre-pandemic average is seen in most major

sectors.

[The various sectors in the multiple sector charts

were grouped together

solely based by the number of new business formations and not by any similarly

between the

sectors. This was done because the trend lines would

not be clearly delineated since the

number of formations varied greatly

among sectors.]

|

|

February 2021

(posted March 5, 2021)

return to top |

|

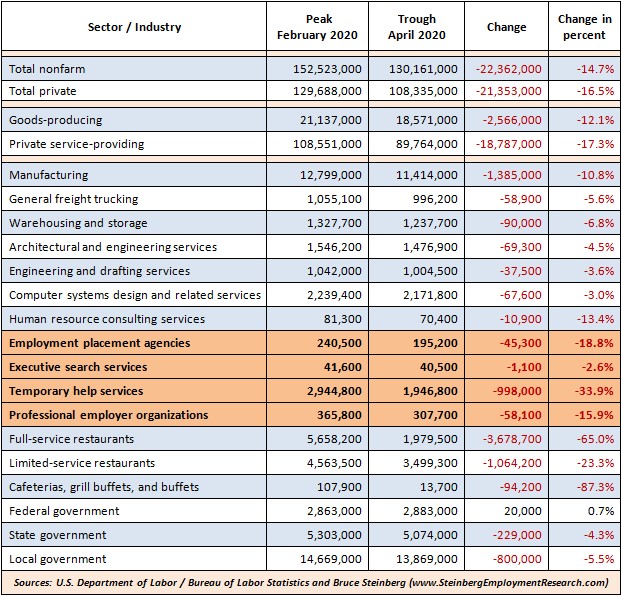

How

the pandemic affected employment by different sectors / industries ...

Although we recently looked at the changes the

pandemic had on the number of jobs in general and specific sectors,

we repeat that examination for some different sectors this month

with

many that are especially relevant to the staffing and IT staffing

sectors. And for comparison, we also look at the changes in the

general labor employment as well as focusing on some sectors that have

been especially hard hit by the pandemic, but may not necessarily be

staffing-centric.

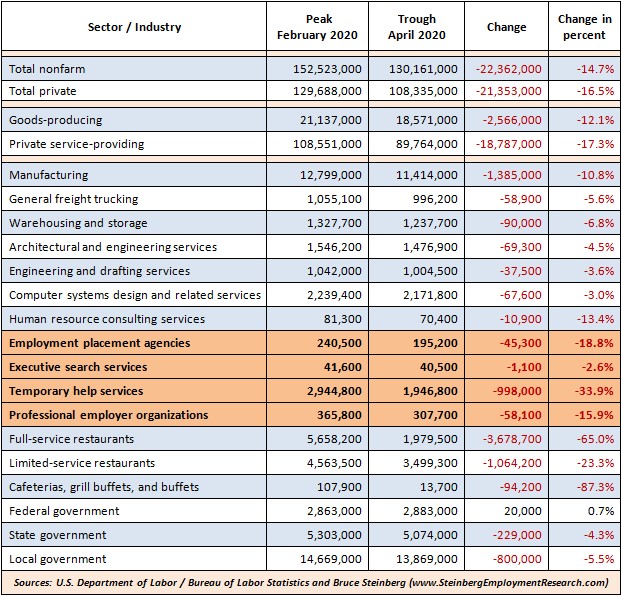

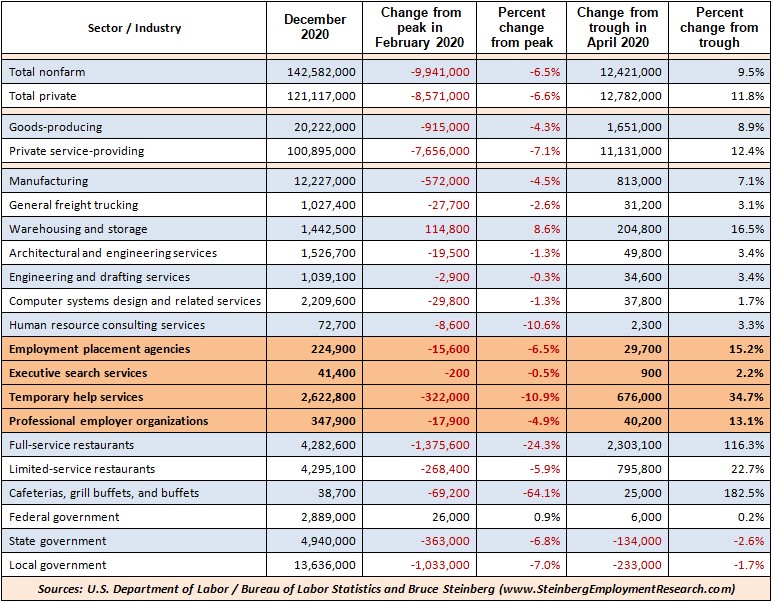

The first table shows the changes made from before

the pandemic hit in February 2020 that was the peak for employment

in most sectors to when the largest jobs

losses occurred in April 2020 that was the low point or trough last year.

The second table shows the changes from the peaks and from the

troughs to December 2020, the last month of the year.

Specifically, the number of all private-sector jobs

dropped 16.5 percent from a peak in February 2020 to the trough in April

2020 (first table) but was still off 6.6 percent by December 2020

(second table) from its peak. However, all private sector jobs have

increased 11.8 percent from the trough in April 2020 at the end of

the year in December 2020 (second table).

Before we discuss the performance of some

staffing-centric sectors, it's interesting to see what has occurred

in some of the restaurant sectors, which has been especially hard

hit by the pandemic. Full-service restaurants were down 65.0 percent

from peak to trough and were still down 24.3 percent from the year's

peak, but recovered 116.3 percent from the year's trough. Regardless

that it is a fairly small sector, cafeterias, grill buffets, and

buffets -- many of which have closed their doors because of the

pandemic -- were down 87.3 percent from peak to trough and were

still down 64.1 percent from the year's peak at the end of the year,

but recovered 182.3 percent from the year's trough.

Since we have faith in our readers are educated

enough to be able to read these tables we will limited our verbiage

to discussing the general trends and leave out the specific numbers

from this point onward.

The private services-providing was hit harder by the

pandemic than the goods producing sector, which is essentially all

private (unless one considers producing red tape by government

entities as "goods producing"). With that said the federal government

was one of only a few sectors that did not lose jobs during the

pandemic. harder by the

pandemic than the goods producing sector, which is essentially all

private (unless one considers producing red tape by government

entities as "goods producing"). With that said the federal government

was one of only a few sectors that did not lose jobs during the

pandemic.

Within the staffing industry, executive search barely

lost its mojo due to the pandemic. Temporary help services, which we

have been reporting about in detail all along, fell off the cliff in

early 2020 had made a nice recovery by the end of the year.

And if the percentage changes in temporary help

services looks familiar to you, they are. Those numbers sort of

mirror the changes in GDP, but along a different timeline. In Q2

2020, GDP dropped 31.4 percent and recovered with growth of 33.4

percent in Q3 2020. This is strictly a coincidence, but interesting

nevertheless.

Did you see it?

Two days ago the Federal Reserve Bank published its

March edition of its round-up of the local economic and employment

situation from each of its12 district banks. It includes many

comments about the staffing and IT services situation and how some

of those business are dealing with today's challenging business

environment. Check it out by clinking

here.

|

|

January 2021

(posted February 5, 2021)

return to top |

|

How

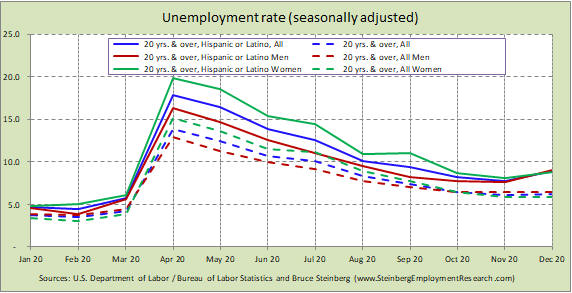

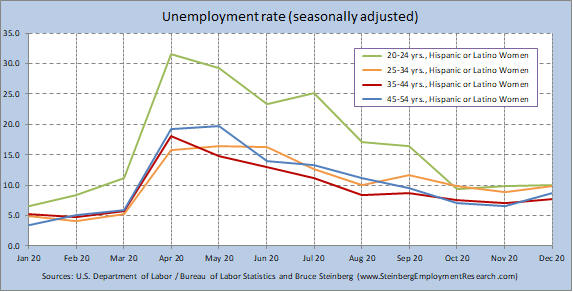

the pandemic affected employment by ethnicity ...

We closed out 2020 by looking

at how the pandemic has impacted the unemployment experience by

gender in November and by race in November. This month we look at

the impacted it has had on the Hispanic or Latino populations and

further by age group and gender.

As the first chart shows that

prior to the pandemic, the unemployment rate for all Hispanic or Latino

men and women was higher than for the overall unemployment rates for

the same cohorts, but not my much. [note: unemployment rates for

non-Hispanic and non-Latino are not available by different age

cohorts. Also, although it may be technically and / or politically

more correct to refer to women as Latina, we report these data by

the official Bureau of Labor Statistics labels.]

Specifically, the

unemployment rate prior to the pandemic in February 2020 for all

Hispanic or Latino was 4.4 percent compared to 3.5 percent overall.

For Hispanic or Latino men 20 years old and over, the unemployment

rate was 3.9 percent and about the same at 3.8 percent for all men

in that age group. However, for all Hispanic or Latino women 20

years old and over, it was 5.0 percent but much lower at 3.1 percent

for all women in that age group.

The unemployment rates for all Hispanic or Latino men

and women started out 2020 at 4.7 percent in January and 3.7 percent

overall for all men and women, a difference of 1.0 percent. However,

the year ended with the unemployment rate for all Hispanic or Latino

men and women at 8.9 percent in December, but 6.2 percent overall

for all men and women, a difference of 2.7 percent. Also take note

that the unemployment rates for men and women for both the Hispanic

and Latino cohorts as well as overall workforce were in a very

narrow range, albeit markedly higher for the Hispanic and Latino

cohort.

In April 2020, the first full month after COVID-19

impacted employment, the unemployment rate for all Hispanic or

Latino shot up to 17.8 percent and but only rose to 13.9 percent

overall. For Hispanic or Latino men 20 years old and over, the

unemployment rate was 16.3 percent but only 12.9 percent for all men

in that age group. For all Hispanic or Latino women 20 years old and

over, it was 19.8 percent but much lower at 15.1 percent for all

women in that age group.

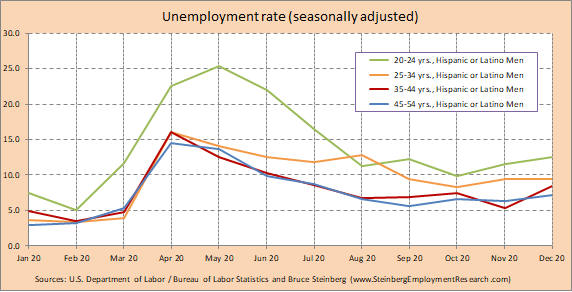

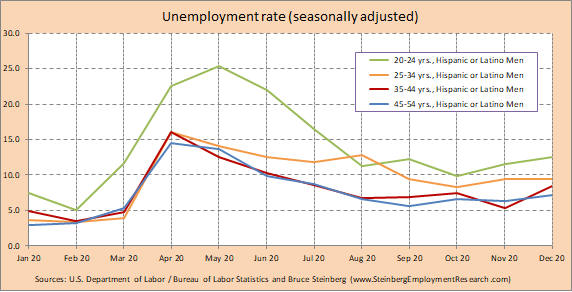

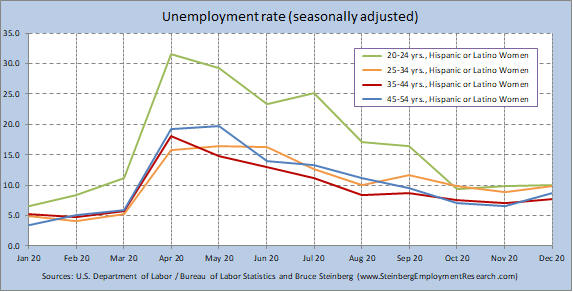

Drilling down further into gender and different age

cohorts, it's understandable that the youngest group for both

Hispanic or Latino men and women -- 20-24 years old -- would have

the highest unemployment rates. Interestingly though, the

unemployment rate for Hispanic or Latino women in this age cohort

peaked in April at 31.5 percent whereas the rate for men in this

same age group did not peak until the following month in May at 25.4

percent.

What the immediate future holds for employment trends

remains unknown because the future direction of the pandemic is also

unknown, but as vaccinations increase, it is expected to slowly

decline. However, the ultimate impact of COVID-19 variants is

creating more questions of how the virus will progress.

That uncertainty creates a cautious environment for

employers and as some businesses are forced to close their doors,

others businesses and individuals who have the fiscal means and

optimism for the for a post-pandemic economy are expanding or

opening. It may be insensitive to say, but this environment of

uncertainty can be a fertile environment for staffing services to

furnish workers into an uncertain future.

|

|

2020 |

|

December 2020

(posted January 8, 2021)

return to top |

|

How

jobs have returned ... and how much further they need to go to

return to where they were ...

Let's start out my wishing

everyone a Happy New Year and hoping 2021 is better than last year.

Instead of sending an e-card to everyone -- and we surmise some of

you would have no interest and that email would just be cluttering

up your inbox, which you may have resolved to keep less cluttered in

2021 -- if you would like to see my personal holiday greeting card,

click here.

Now, to get down to business.

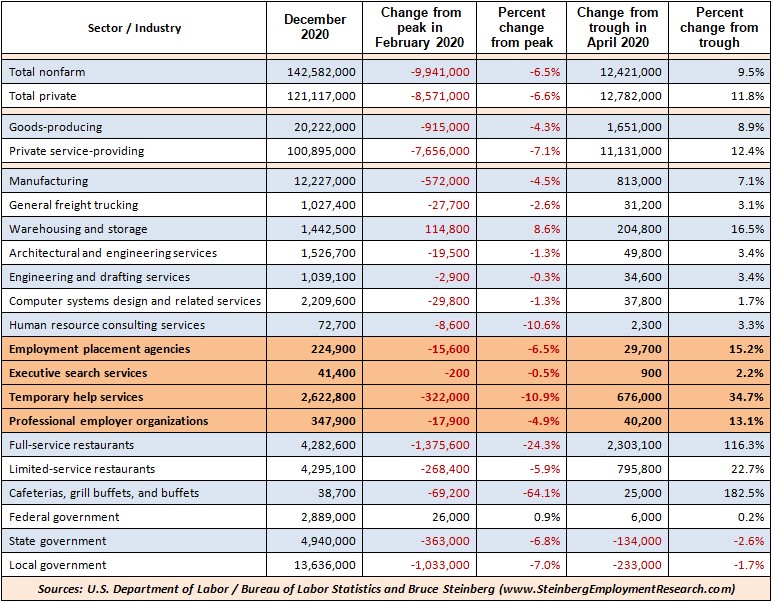

We thought it would be interesting to see how some industries /

sectors have recovered -- or have started to recover -- from the the

loss of jobs due to the pandemic. Because this analysis was prepared

earlier this week before the December 2020 employment situation was

released, we only have examined the 2020 jobs data to November 2020.

The peak in 2020 for jobs was in February and troughed two months

later in April.

[note: depending upon how

your browser and / or email program renders the above chart, it may

be difficult to view; we suggest you click on it to open a larger

version.]

Total nonfarm jobs dropped

14.5 percent to its trough in April from its peak in February and

still down 6.5 percent from its peak but up 9.5 percent from its

trough. Private-sector jobs performed similarly. And the changes for

most industries and sectors followed the same basic trends.

We won't go through each of

the sectors or subsectors that are presented in the table -- you can

see that for yourselves in the chart -- but will highlight some

specifics for the outliers to the overall job trends.

It should come as no surprise

that jobs in food services and drinking places -- more commonly

referred to as restaurants and bars -- plummeted 41.4 percent in

April and was still down 17.2 percent from its peak despite being up

63.7 percent from its trough.

On the other end of the

spectrum, computer systems design and related services, which only

dropped 3.6 percent to its trough and was still only down 3.1

percent from its peak, is only up 0.4 percent from its trough.

And temporary help services

that had experienced a lot of pain and dropped 30.3 percent into its

trough and was still down 10.0 percent in November from its

peak, is up a healthy 29.1 percent from its trough.

The employment situation is

either on the mend or still has a long way to go depending upon

one's point of view -- sort of a glass half-full / half-empty thing. If you find this information

interesting and helpful and would like to see similar data for other

industries / sectors,

let us know and we may just

address it in the future.

|

|

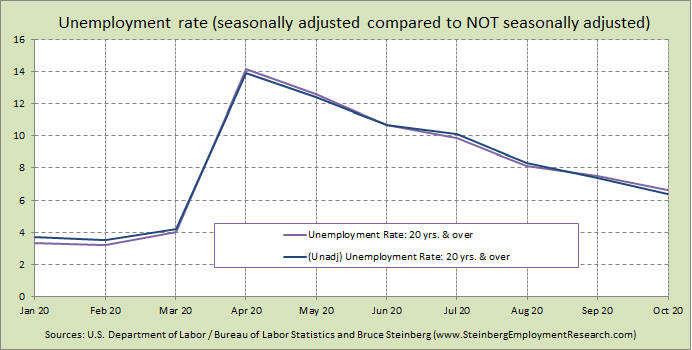

November 2020

(posted December 4, 2020)

return to top |

|

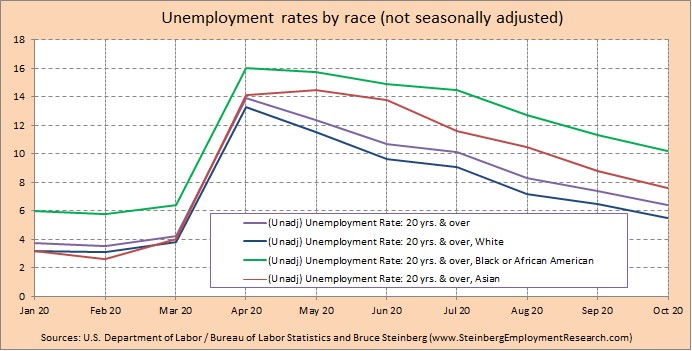

How

the pandemic affected employment by race ...

Last month we looked the

effect the pandemic had on employment -- well, unemployment to be

more precise -- by gender and drilled down further by age grouping.

This month we look at the pandemic's effect on unemployment by race.

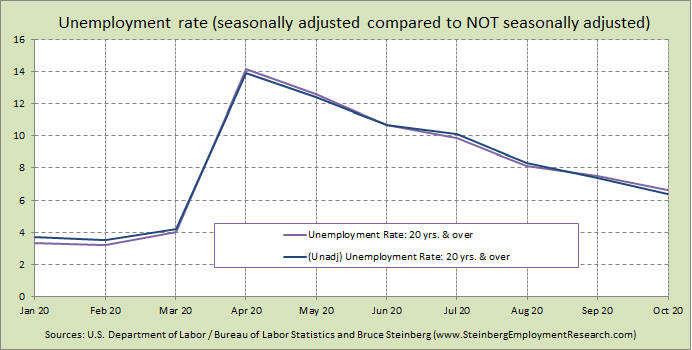

We normally prefer to examine unemployment trends by seasonally

adjusted data but unfortunately unemployment rates for some races are

only published on a not seasonally adjusted basis.

But, the difference between

seasonally adjusted and not seasonally adjusted data series for all

persons 20 years and older is fairly minor and doesn't significantly

change the trendlines. Additionally, the differences between the

trendlines of seasonally adjusted and unadjusted unemployment rates

by race do not vary much from the trendline for all persons so they

are not charted / presented here, but will send them upon

request.

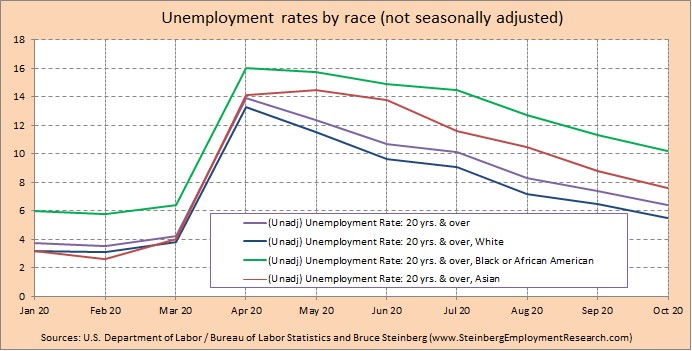

In January and February the

unemployment rate for White and Asian persons 20 years and older was

slightly under than for all workers and significantly higher for

Black or African American persons (sidebar: these race names are those

used by the Bureau of Labor Statistics). While the unemployment rate

for Black or African American was around 6 percent, it was under 4

percent for all White and Asian persons 20 years or older. In March

2020 -- the month before the pandemic affected unemployment rate

measurements -- the overall unemployment rate was 4.2 percent for

all persons broken out as 3.8 percent for White, 4.0 percent for

Asian, and 6.4 percent for Black or African

American.

The following month in April

2020 as the pandemic hit the job market, the overall unemployment

rate for persons 20 years and older skyrocketed to 13.9 percent

and to 16.0 percent for Black or African American, 14.1 percent for

Asian, and 13.3 for White. After the peak in April, the unemployment

rates generally trended downward with one exception; the Asian

unemployment rate rose 0.4 percentage point to 14.5 in May.

However, the gap between the

unemployment rates for all persons and race show varying trends.

Prior to the pandemic, the unemployment rate in Q1 2020 was a little

more than 0.4 percentage point below the overall rate for White; a little

less than 2.3 percentage points higher for Black or African American,

and a little more thanb 0.5 percentage point lower for Asian.

But the current gaps between

the unemployment rates by race -- although generally continue to

decline -- show different trends.

For White, the gap in October

2020 was 0.9 percentage point lower compare d

than the overall unemployment rate to the gap of 0.4 percentage

point lower in March 2020. For African American, the gap in October

was 3.8 percentage points higher than the overall unemployment rate

compared to 2.2 percentage points higher than in March. And the gap

was 1.2 percentage points higher than the overall unemployment rate

in October compared to being 0.2 percentage point lower in March for

Asian. d

than the overall unemployment rate to the gap of 0.4 percentage

point lower in March 2020. For African American, the gap in October

was 3.8 percentage points higher than the overall unemployment rate

compared to 2.2 percentage points higher than in March. And the gap

was 1.2 percentage points higher than the overall unemployment rate

in October compared to being 0.2 percentage point lower in March for

Asian.

|

|

October 2020

(posted November 6, 2020)

return to top |

|

How

the pandemic affected unemployment by gender ...

There's a subject that is

only now starting to be examined and reported in the media in

earnest ... how the pandemic has impacted the employment status of

women.

The unemployment rate for women and men has basically been about the

same for some time. Conveniently -- for our purposes -- in March

2020, which was prior to the pandemic impacting employment, the

unemployment rate was the same for men and women at 4.0 percent.

Although COVID-19 has been

hard on all working people, women were and are more negatively

affected.

The following month in April

2020 the overall unemployment rate rate skyrocketed to 14.2 percent

with 15.5 percent for women and 13.0 percent for men. The difference

between genders of 2.5 percentage points is not insignificant. There

is no monolithic reason for the higher unemployment rate for women.

Regardless of gender or

workforce politics, lower wage jobs are disproportionately held by

women and lower wage jobs were and are disproportionately impacted

by the pandemic. In addition, the childcare system and K-12

education -- other than being disproportionately staffed by women --

took a major hit from the pandemic that many believe are not able to

accommodate the needs of working women, who -- agree with it or not

-- are the major caregivers for children.

Breaking out unemployment

rate by different age cohorts yields predictable results with

younger persons taking the bigger hits regardless of gender on the

job front likely because they are in lower wage jobs.

Although many smaller

services businesses -- think local restaurants (aren't all

restaurants basically local businesses?) as one example -- have

permanently closed, it will be some time before those jobs return

and those businesses are reestablished.

In addition, forward-thinking

businesses are taking advantage of the slowdown and trimmed down its

workforce to automate processes where and when possible to be more

productive. So even when activity returns to pre-pandemic levels,

they will likely need fewer workers.

|

|

September 2020 (posted October 2, 2020)

return to top |

|

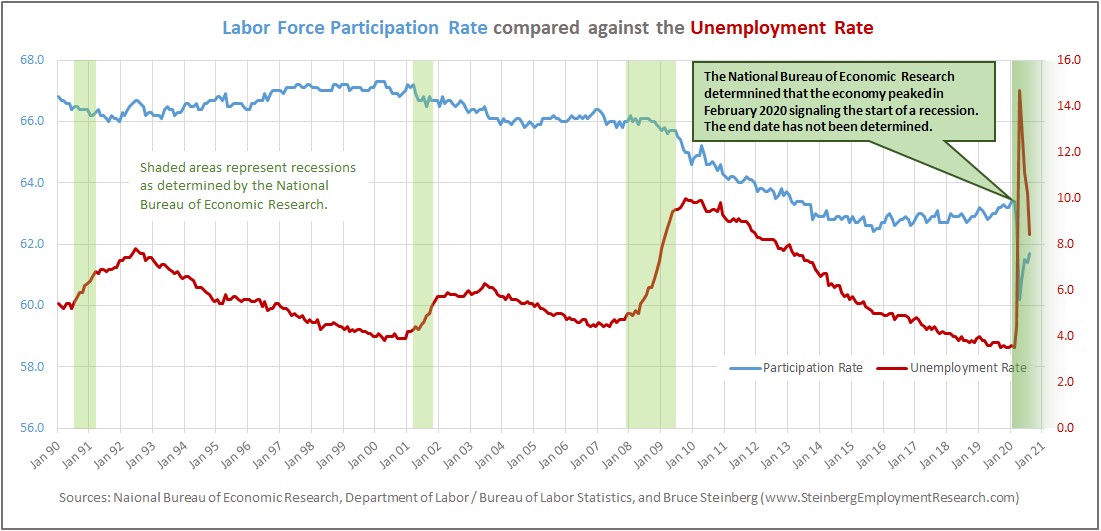

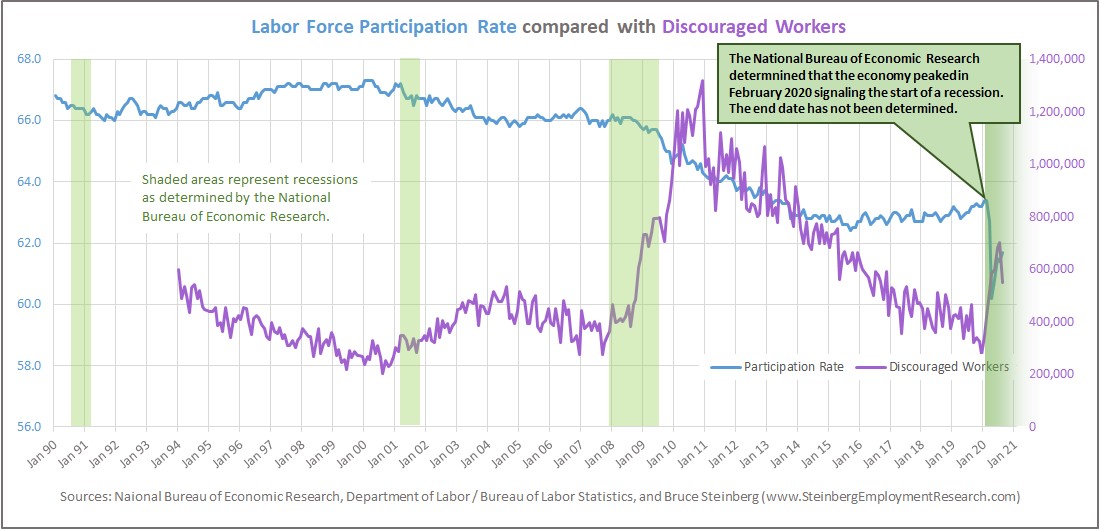

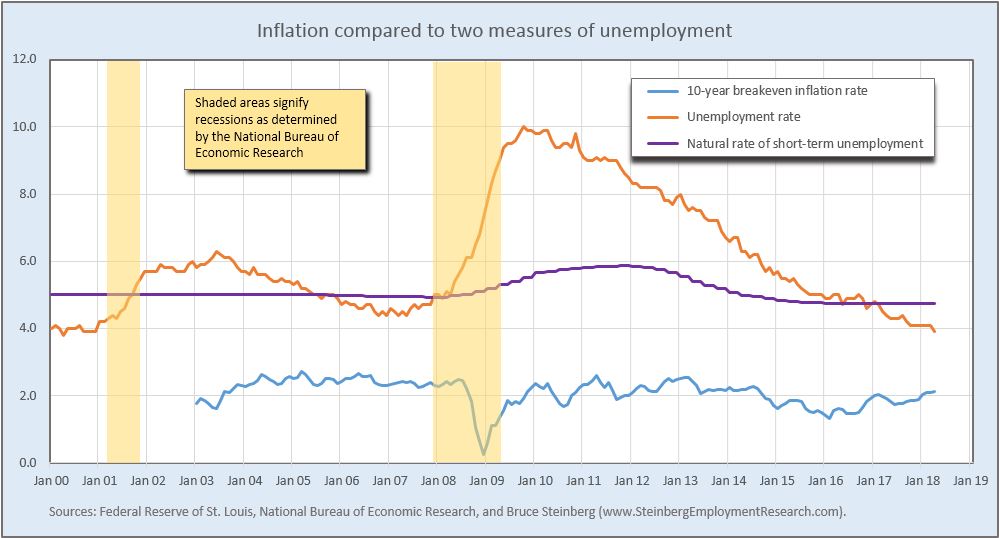

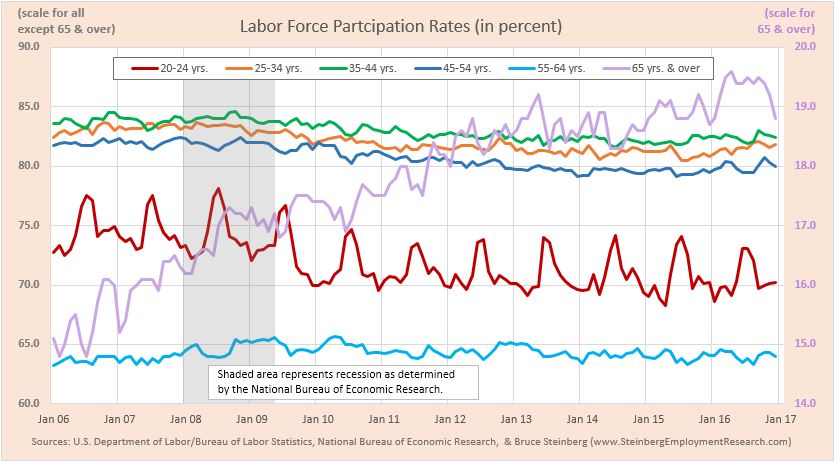

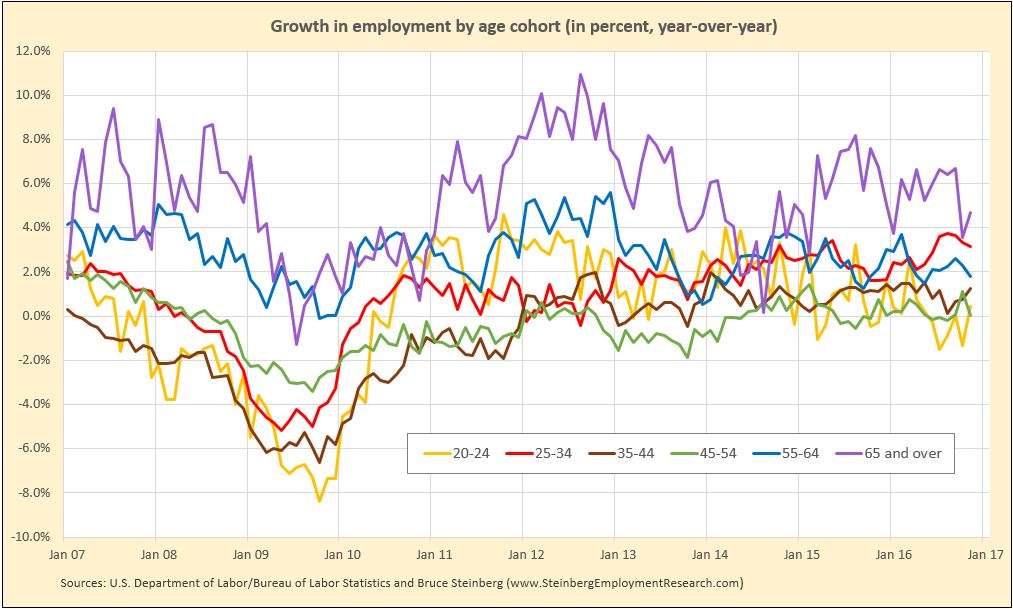

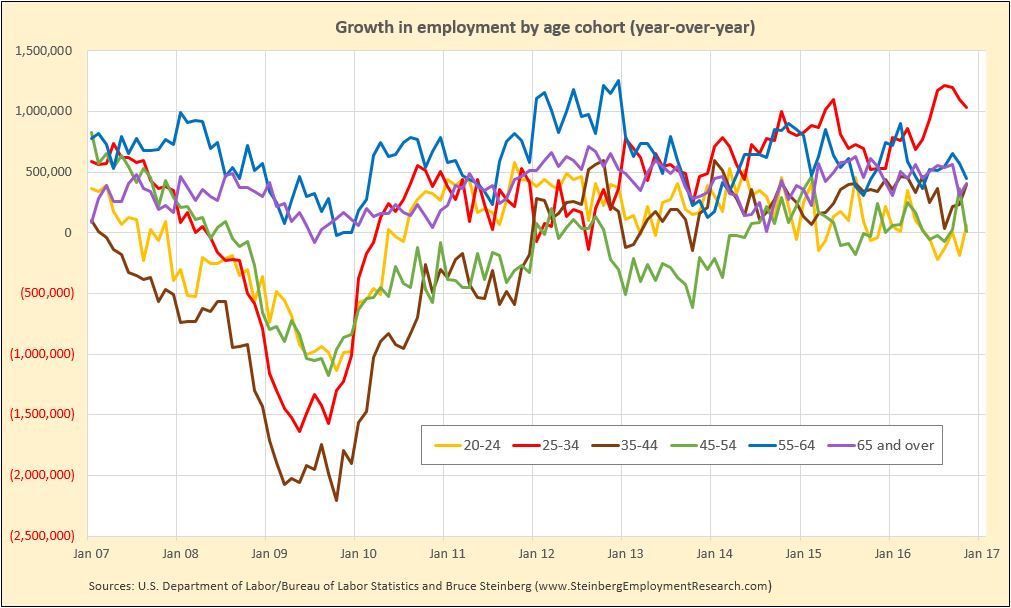

Three years ago, we

poised the question "Will there be enough workers?" Now we

ask, "What does that same data tells us today?"

After examining the apparent

disconnect between low unemployment and fairly stagnant wages / low

inflation as the Phillips Curve appeared to no longer be functioning

properly in

August 2017, the next month in

September 2017 we ponder the

question "where will workers come from?"

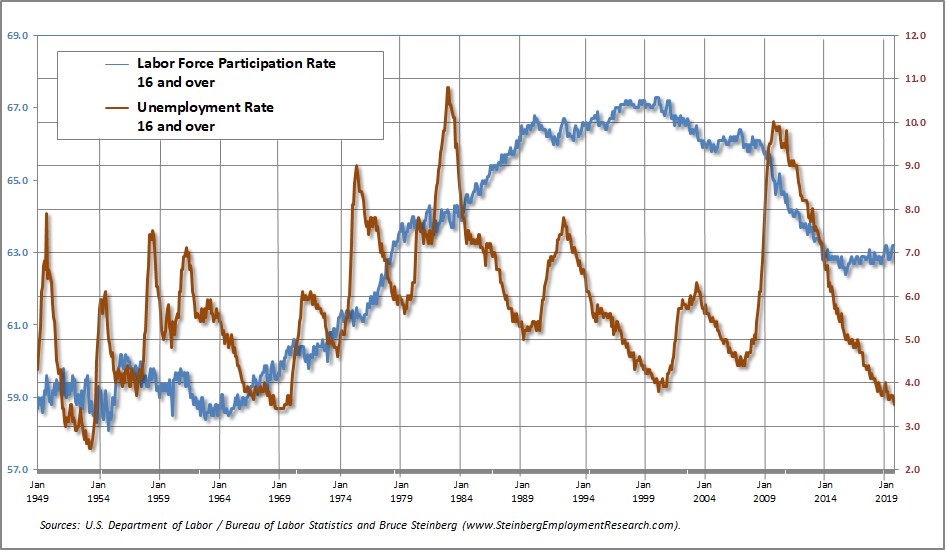

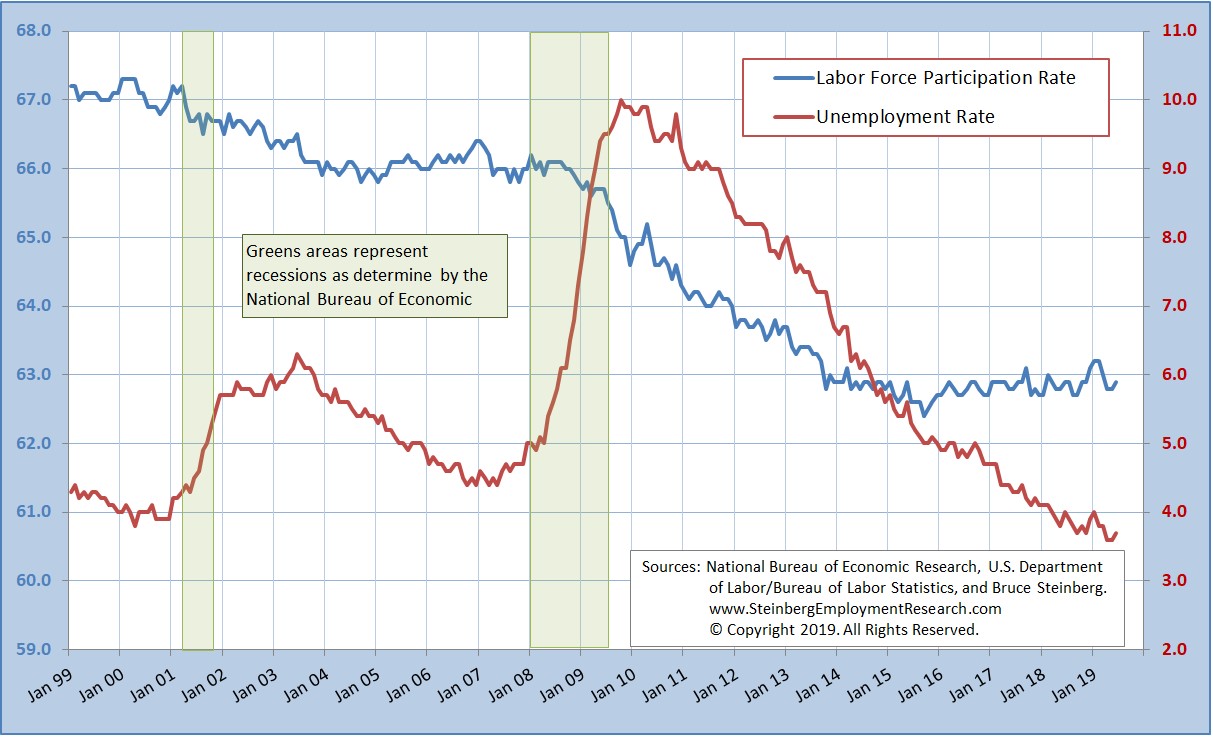

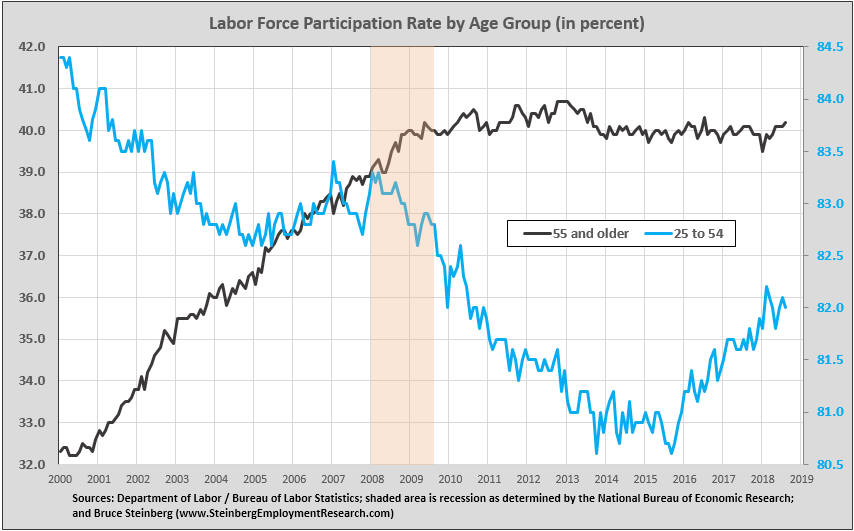

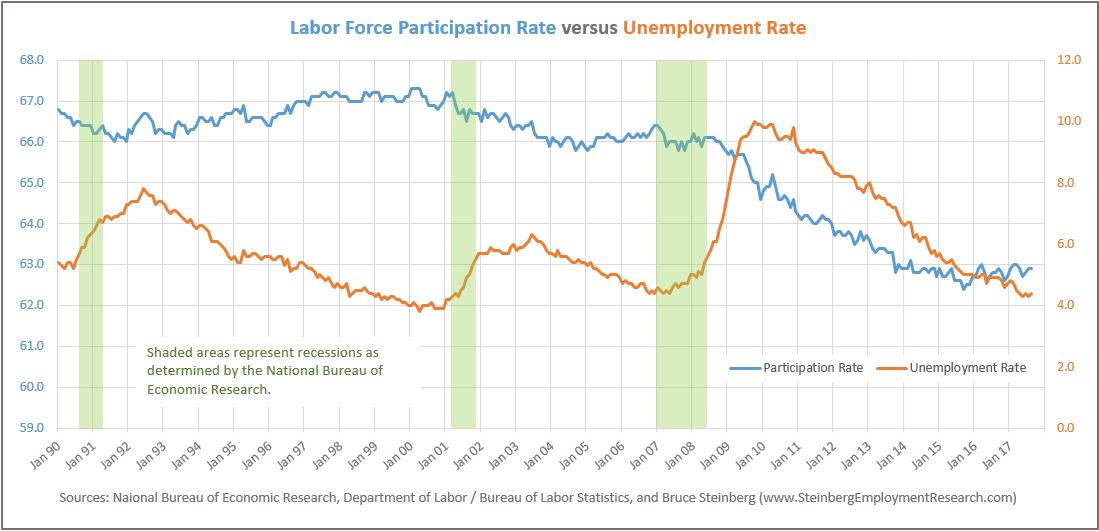

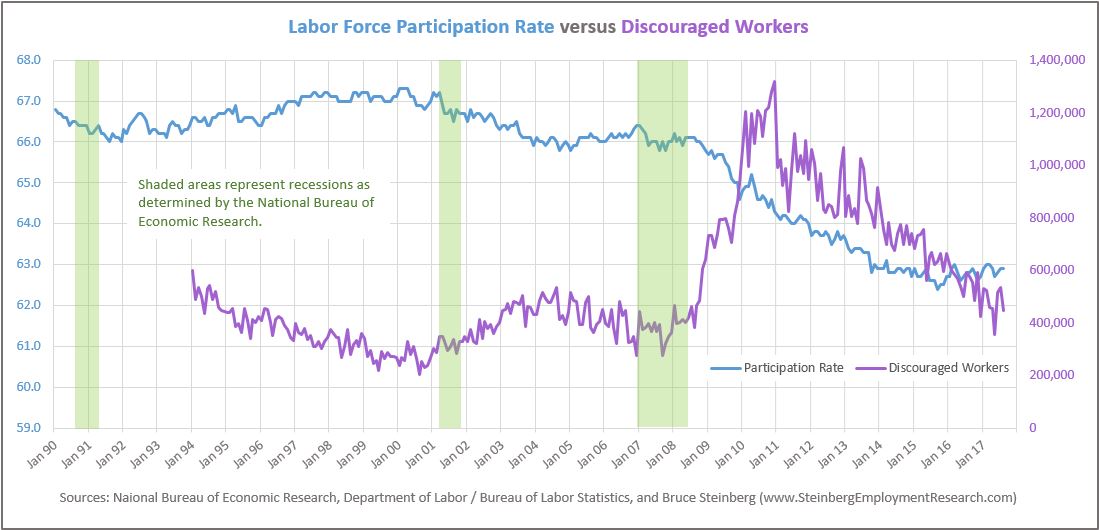

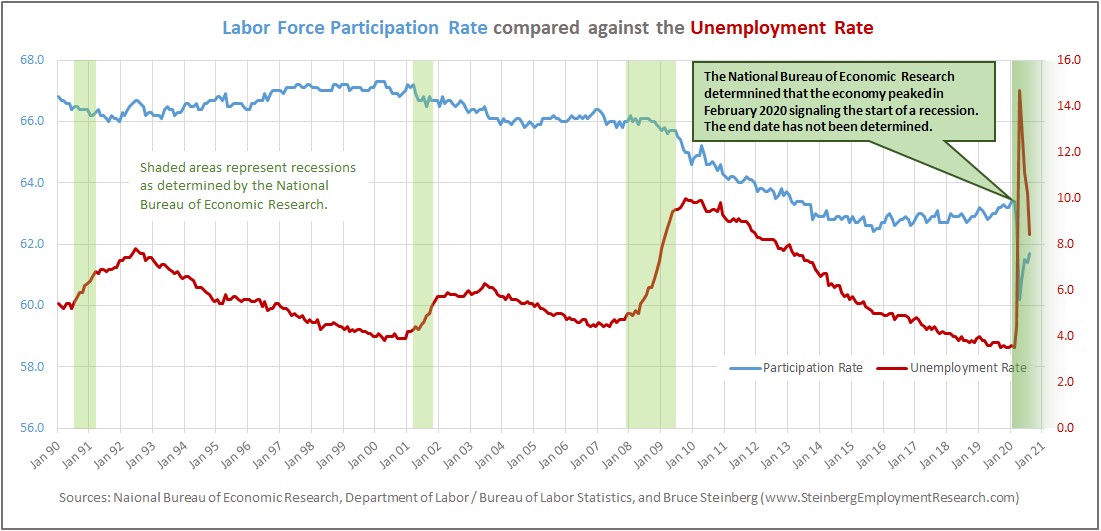

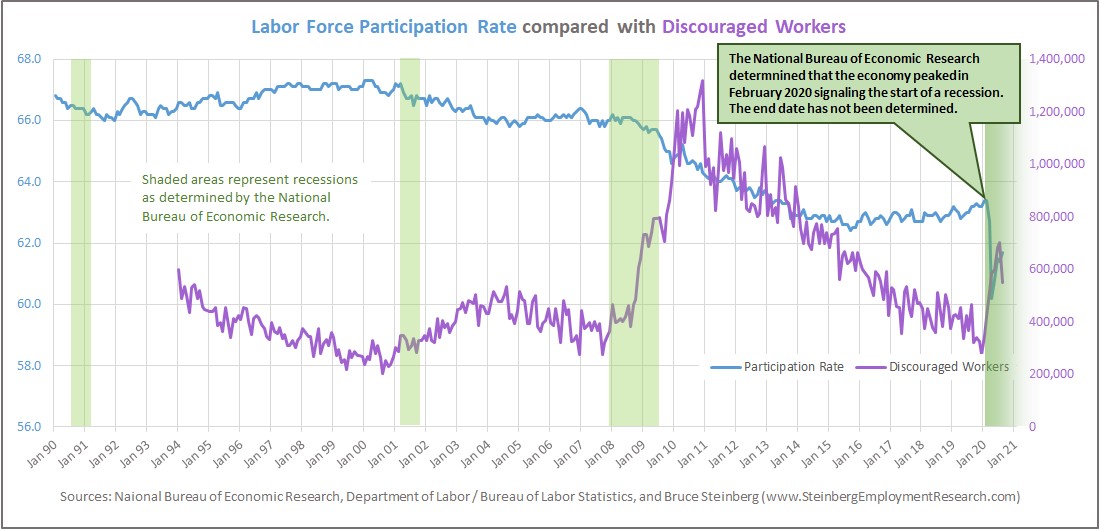

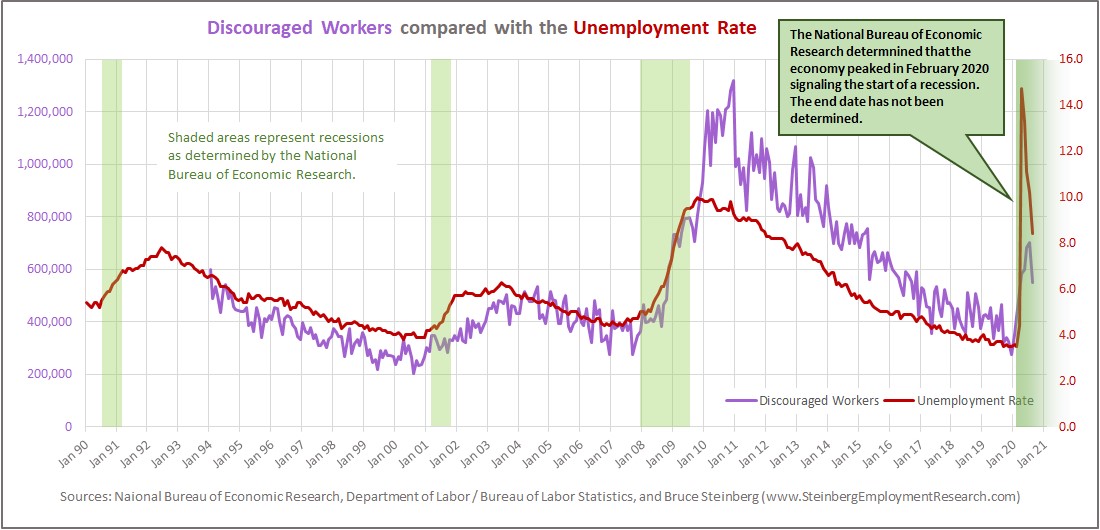

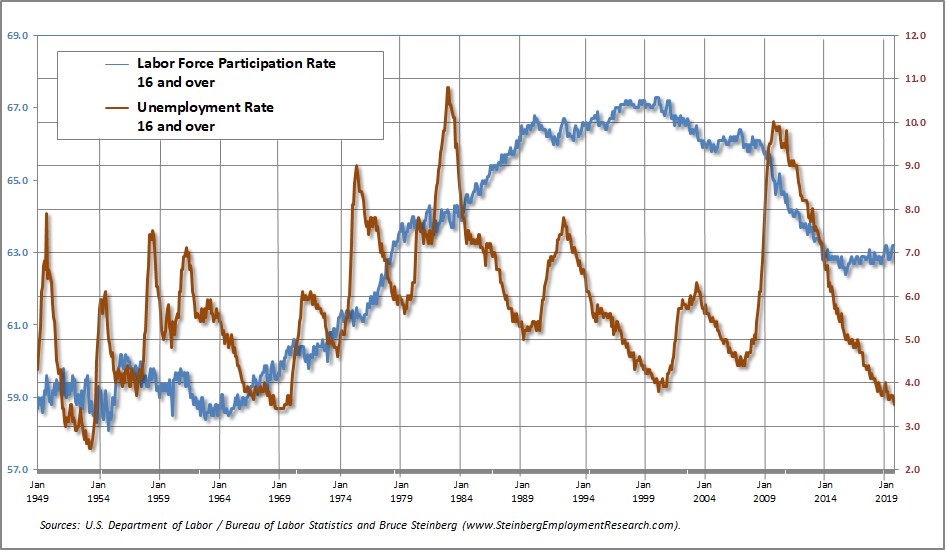

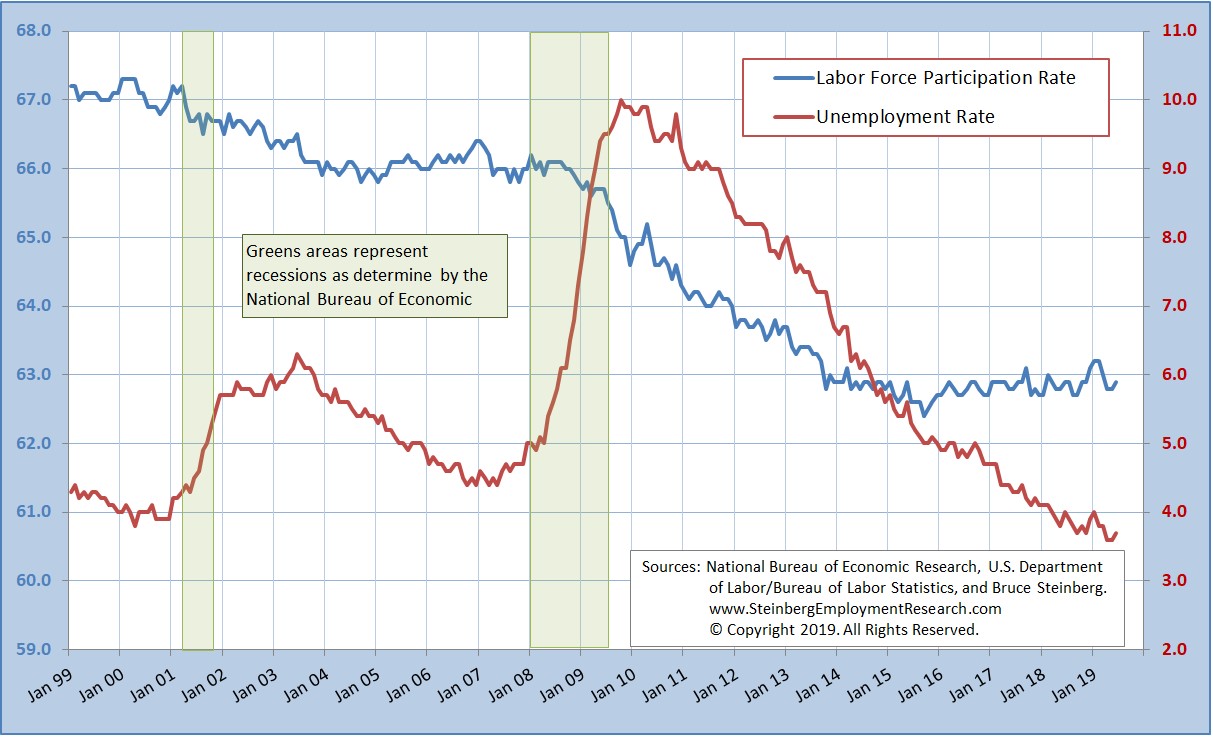

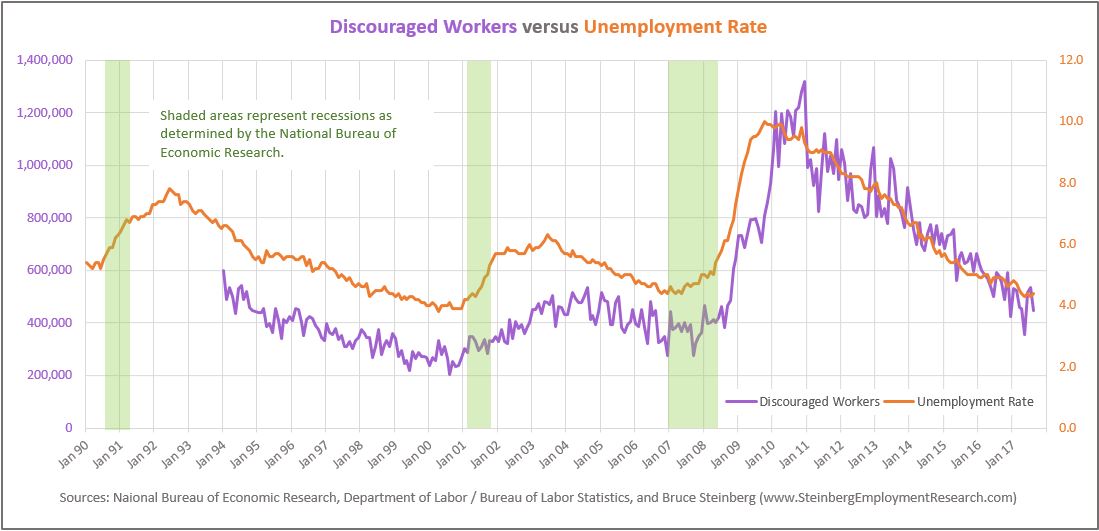

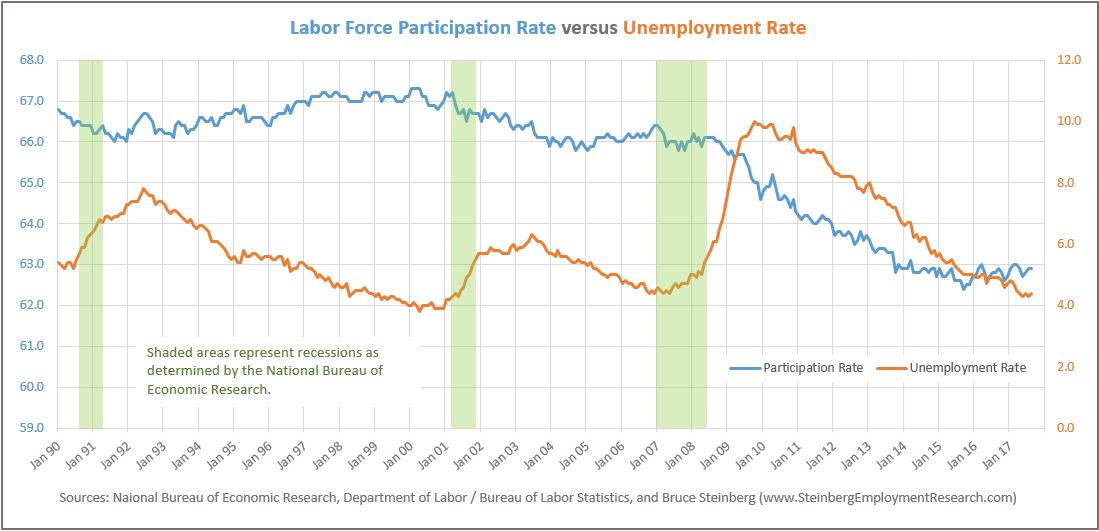

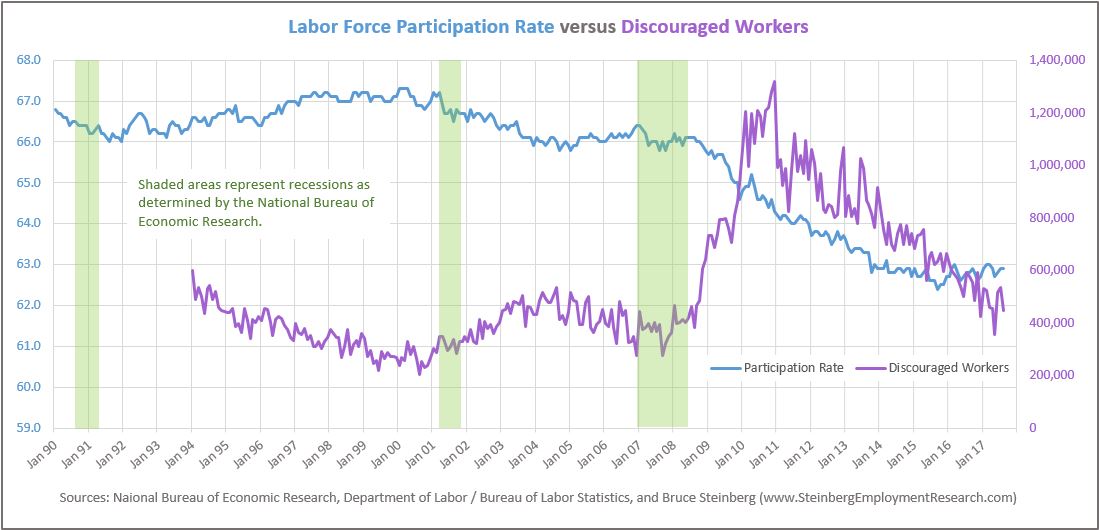

At that time, we looked at labor force participation rate, the number of

discouraged workers, and the unemployment rate. In the far corners

of the business and economic news, there has been recent writings

that the Phillips Curve has also been a victim to COVID-19. But,

we concluded three year ago that the Phillips Curve did not seem to

be working in the then economy. But, times have dramatically

changed.

It

doesn't take an economist to see that the pandemic has and is

playing havoc with these three specific measurements of employment. It

doesn't take an economist to see that the pandemic has and is

playing havoc with these three specific measurements of employment.

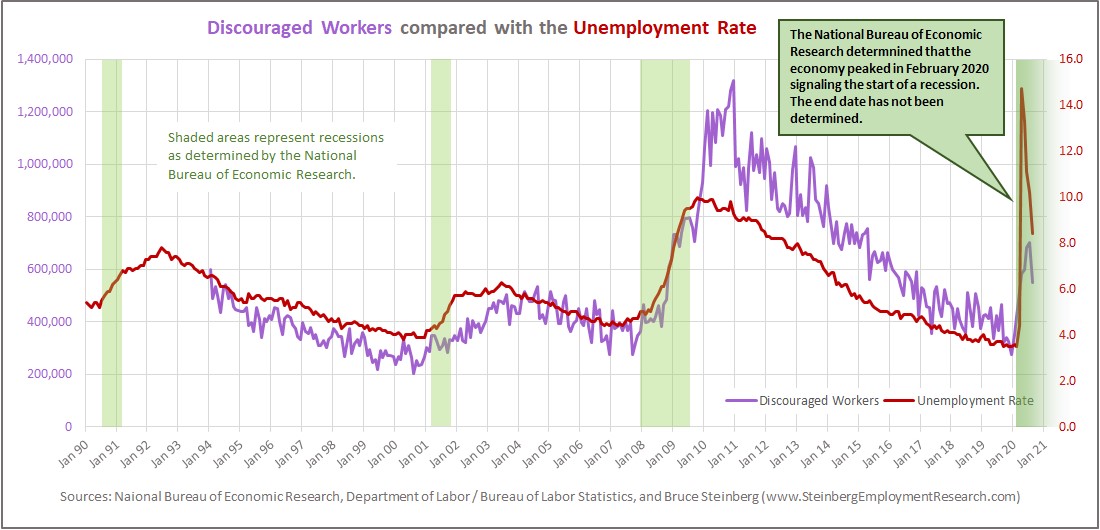

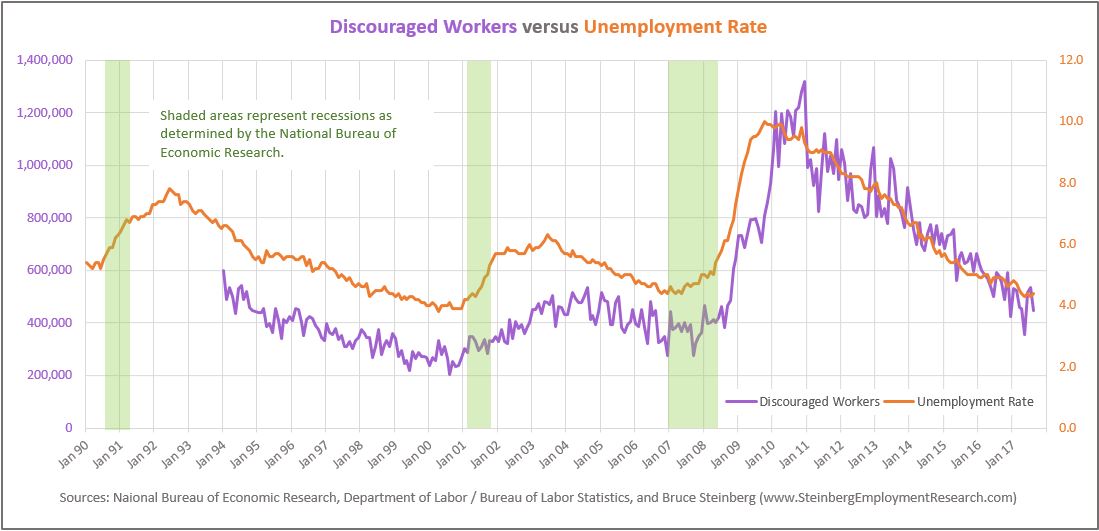

During the past three recessions, as the unemployment rate

increases, the labor force participation rate has declined. And that

inverse relationship is especially dramatic in the current

recession. Yes folks, we are likely still in a recession right now. With

so many other developments dominating the news cycle, don't feel bad

that you missed the National Bureau of Economic Research's

announcement in early June 2020 that the economy peaked in February

2020 and therefore entered a recessionary period.

The labor force participation rate had been basically declining

since early 2000. Although there are a multitude of reasons, such as

changing demographics including declining retirement ages and

policies encouraging college enrollments that removed many younger

people from the workforce. Perhaps it's time to rethink how the

labor force participation rate is calculated.

The

number of discouraged workers continues to rise immediately after a

recession is officially declared over and the economy reenters

growth mode. Why do their numbers continue to rise after a recession

is over? Because many people who may have been sitting out the

recession on the sidelines, think they can get a job soon after the

recession is declared over. But, it takes time for companies to

readjust their business and staffing plans and start to create jobs

and hire to fill them. The

number of discouraged workers continues to rise immediately after a

recession is officially declared over and the economy reenters

growth mode. Why do their numbers continue to rise after a recession

is over? Because many people who may have been sitting out the

recession on the sidelines, think they can get a job soon after the

recession is declared over. But, it takes time for companies to

readjust their business and staffing plans and start to create jobs

and hire to fill them.

Although the Phillips Curve

may still be bending the same way, globalization and regional

economic conditions have muted effects on prices and made it

somewhat irrelevant. Employment is still a lagging indicator. Hence the number

of discouraged workers and even the unemployment rate continues to

rise in the period immediately after the end of a recession. As the

labor force participation rate plunged upon the onset of the

pandemic, the number of discouraged workers increased. Although both

these metrics have begun to reverse direction, they still have a

ways to go before getting back to their pre-pandemic levels.

The

same trends are seen with the number of discouraged workers and the

unemployment rate. The official unemployment rate, after

skyrocketing at the beginning of the pandemic and has dropped

considerably, but is still at the level observed in late-2011 /

early-2012. However, the current trend of a relatively high

unemployment rate is at least partially due to other factors other

than people not being able to secure a job such as rich unemployment

benefits and workers staying home due to the lack of child care

options. The

same trends are seen with the number of discouraged workers and the

unemployment rate. The official unemployment rate, after

skyrocketing at the beginning of the pandemic and has dropped

considerably, but is still at the level observed in late-2011 /

early-2012. However, the current trend of a relatively high

unemployment rate is at least partially due to other factors other

than people not being able to secure a job such as rich unemployment

benefits and workers staying home due to the lack of child care

options.

To answer the question we

poised three years ago if there will be enough workers -- the answer

is yes, but the question remains if people want to go back to work

and if there will be enough jobs.

Clearly the pandemic has changed the operations -- and hence, the

staffing requirements -- of many sectors and industries. When the

pandemic ends -- and it will -- how will staffing in the

post-pandemic economy be affected? This country's economy morphed

from agrarian, to industrial, to manufacturing, to service, and to

information-driven. Will there be such a stage labeled a

"post-pandemic" economy? First, we have to see the Covid-19 in the

rearview mirror but simultaneously keep an eye on what's in front of

us. The best advice is fasten your seat belts for what will likely

be a bumpy ride -- and wear a mask!

|

|

August 2020

(published September 4, 2020)

return to top |

|

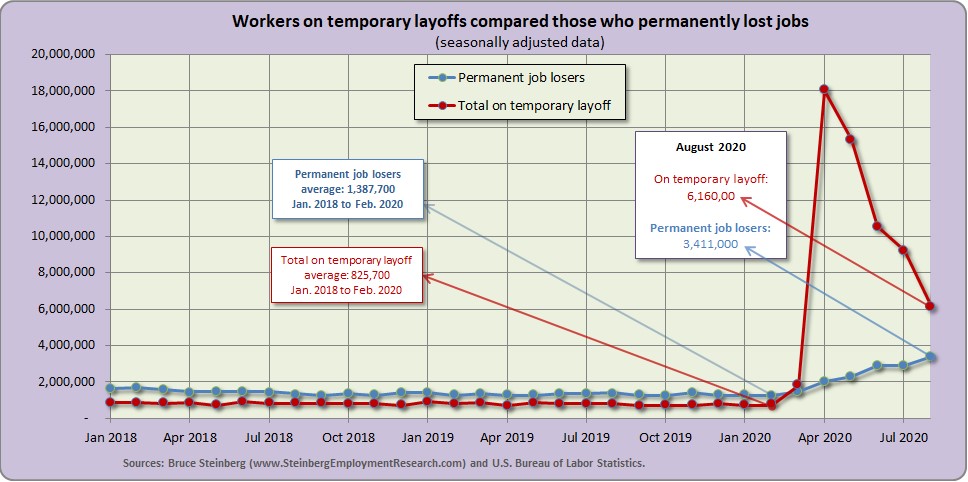

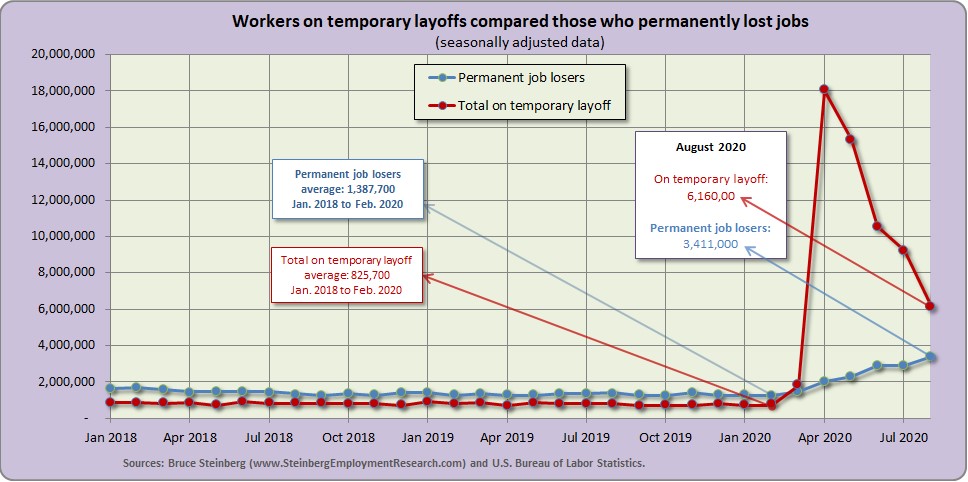

Are jobs and employment going sideways?

Two days ago the Federal Reserve Board published its September 2020

edition of the Beige Book, their regional and sector anecdotal

observations of the economy. Several common themes cropped up

throughout the country and we'll examine one of them more closely.

Back in

April 2020 and

May 2020, we mentioned that a

lot of workers who self-reported that they were furloughed -- and

characterized by the Bureau of Labor Statistics as "on

temporary layoff" by not really have been on temporary layoff, but

questioned if it was "wishful thinking that they will be recalled

from layoffs? Also, are employers are not being frank by dangling

the prospect that furloughed workers will be the first to be rehired

when, in fact, employers will use this as a way to eliminate workers

whose productivity does not meet the possibly new and reduced level

of activity?"

The latest data this month's BLS month's employment situation seems

to indicate that workers' expectations of returning to their jobs

may indeed had been overly optimistic. As the chart shows, the

number of permanent jobs losers has been steadily increasing, albeit

at a slower rate of increase than those on temporary layoffs have

been decreasing. In August, there were ?,???,??? permanent job losers

while there were ?,???,??? on temporary layoffs, or on furlough.

Pivoting back to the Fed's recent Beige Book, it seems that some

employers / businesses are deciding that there are no longer jobs

for laid-off workers, " ... Some larger firms also reported laying

off furloughed workers in the face of slower recovery." In another

part of the country, "...

a few firms reported that previously furloughed workers have

recently been laid off permanently —

a sign that the labor market's recovery may not be smooth."

And similar comments from other parts of the country include: "...

many contacts noted that some prior staff cutbacks were permanent,

and others had used attrition to reduce headcount." and another

employer told the Fed, "I anticipate furloughs becoming layoffs if

some of our shelved work doesn't start up."

Our summation of the Federal Reserve Board's

latest

Beige Book highlighting developments and reports about trends in

regional employment and wages, staffing services, information

technology, engineering, manufacturing and other industries that

drive the staffing and IT sectors is

here.

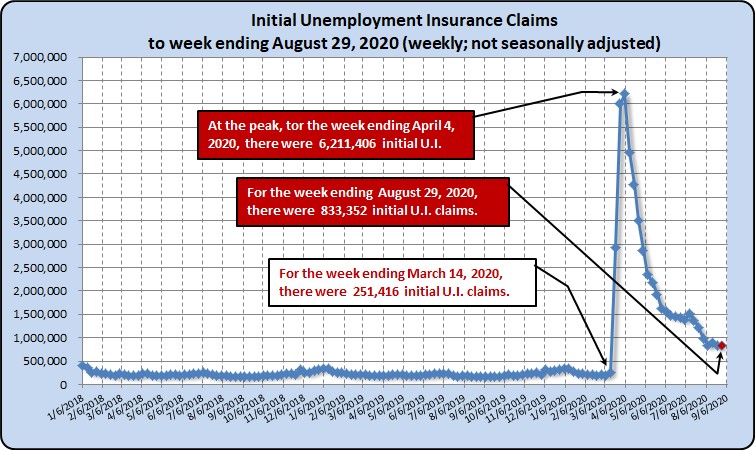

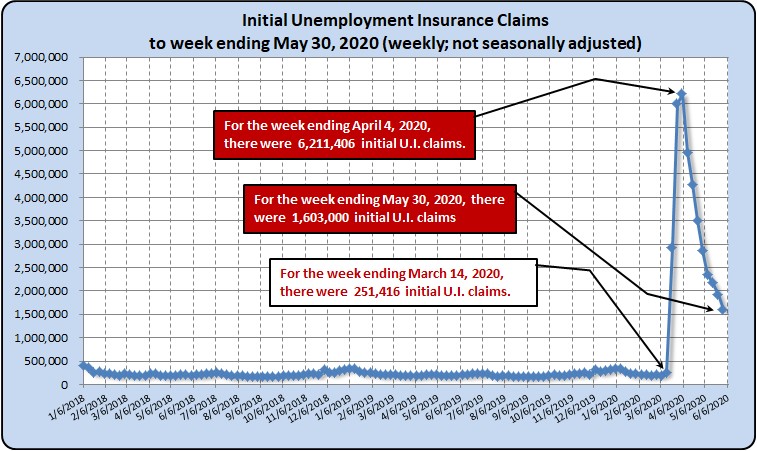

Initial unemployment claims still very high

...

The latest Beige Book also discussed that the rich unemployment

benefits appear to be keeping workers from going back to work. A

typical comment: "... generous unemployment benefits had made it

difficult to bring payrolls back to desired levels, especially at

the entry level."

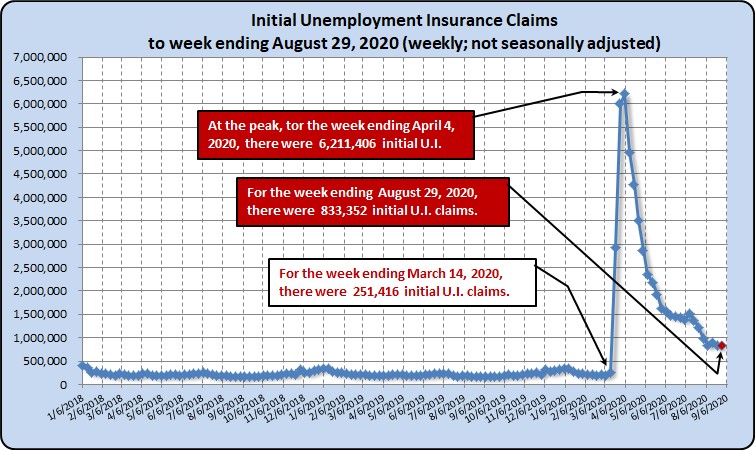

The number of initial unemployment claims rose last week, but by a

relatively small amount. BTW, the Labor Deportment changed the

seasonally adjustment methodology because of the pandemic, which is

why we have always reported the not seasonally adjusted data for

this series. |

|

July 2020

(published August 7, 2020)

return to top |

|

How many people are unemployed? Does anyone know?

Last month we titled our opening analysis as "Has unemployment been misstated?

Yes -- read on if you want more detail."

The title of an article published in the spring 2020

issue of Chicago Booth Magazine, which is the alumni magazine of the

University of Chicago Booth School of Business, pretty much confirms

what we surmised last month: "U.S. Unemployment Is Even Worse Than the

Official Numbers Say."

Click here for the one-page

research digest.

It's a very important question, so this month we look at this

subject with

different data to try and figure out not necessarily what the actual

unemployment rate is, but what is the real trend with employment /

unemployment.

The pandemic has affected the employment-to-population ratio, which

normally `varies little from month to month. But in April 2020 it

plummeted 8.7 percentage points from the previous month when it rarely varies more than 0.1

percentage point on a sequential basis. Likewise, but not as dramatic, for the civilian

labor force participation rate that dropped to 2.5 percentage points

in April. Both these metrics have been making gains since then, but

still are not quite back to pre-pandemic levels.

The changes in the percentage changes do not necessarily tell what

really is happening. The next charts shows the change in the size of

the civilian labor force from month to month. Again, pre-pandemic it

has been fairly steady -- average a change of about 200,000 for the

months of May 2019 to February 2020, inclusive, before starting to

decline

in March and plummeting in April 2020 and starting to rebound in May

2020.

But the question remains about what about those who

think of themselves as no longer in the workforce -- are they just

unemployed and no longer consider themselves as part of the labor

force but may return if an opportunity presents itself, or have they left the workforce

for good. These data really does not answer that question.

Regardless, it appears that many

of people have left the workforce. The exodus began in March 2020 and peaked the next month in April,

when many more decided to

hang it up and file for a separation from the labor

force. However, in the subsequent months of May and June -- although

many are still leaving the labor force -- the rate of exit is

moderating, but still much greater than it has been.

|

|

June 2020

(published July 2, 2020)

return to top |

|

Has unemployment been misstated?

Yes -- read on if you want more detail ...

In our report of the April 2020 employment situation, we questioned,

"Are

workers accurately reporting their job prospects or is it wishful

thinking that they will be recalled from layoffs? Also, are

employers are not being frank by dangling the prospect that

furloughed workers will be the first to be rehired when, in fact,

employers will use this as a way to eliminate workers whose

productivity does not meet the possibly new and reduced level of

activity?"

One month later in a 15-page FAQ released simultaneously with the May jobs report

in June 5, the Bureau of Labor

Statistics, admitted that many workers were misclassified as

"employed but not at work" when in reality they "... should have

been classified as unemployed on temporary layoff." We won't get

deep into the weeds why the misclassification error occurred, but we

are quite sure there was no political pressure -- actually the only

political appointment at BLS is the commissioner and he has no

influence on the final published numbers, which is a highly

automated process overseen by career BLS economists.

With that said, BLS's FAQ elaborated" "Of the 8,400,000 employed people not at work during

the survey reference week in May 2020, 5,400,000 people were

included in the 'other reasons'." This was much, much higher

than the 549,000 average for May 2016-2019. "BLS analysis of the

underlying data suggests that this group included workers affected

by the pandemic response who should have been classified as

'unemployed on temporary layoff'."

Outside economists estimate that this error means that the actual

April unemployment rate should have been closer to almost 20 percent

instead of 14.7 percent that was officially reported. And the May

unemployment rate should be around 16.1 percent instead of 13.3

percent that was officially reported.

A little side note from "the weeds": answers from the survey are

accepted as recorded and "no ad hoc actions are taken to reassign

survey responses." BLS further explains "Such a misclassification

... can occur when respondents misunderstand questions or

interviewers record answers incorrectly." Obviously, BLS and the

Census Bureau -- Census actually administers the survey instrument

for BLS, but we digress -- acknowledged the problems the pandemic

has had on the data and are conducting additional training and

adding more instructions into the survey instrument.

In blog post on June 29, which was essentially a restatement of the

June 5 FAQs, the BLS commissioner admitted, "Although we noticed

some improvement for May, the misclassification persisted."

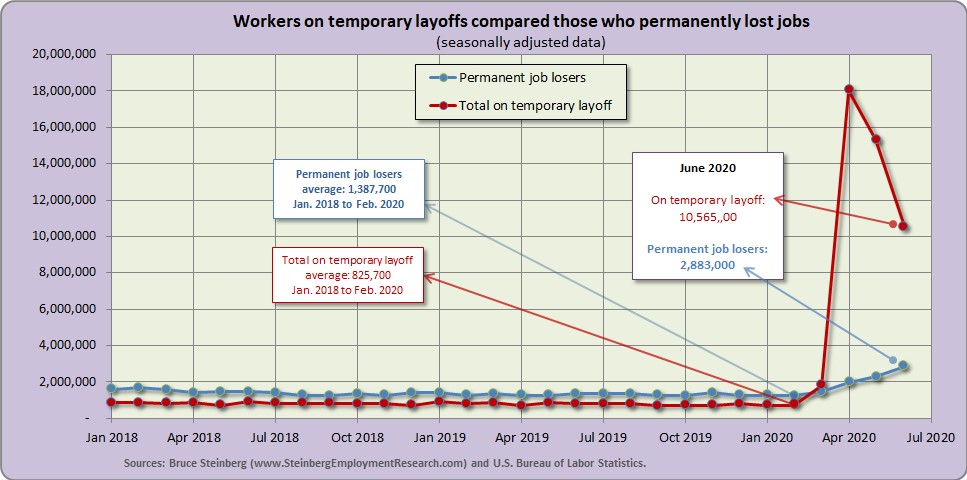

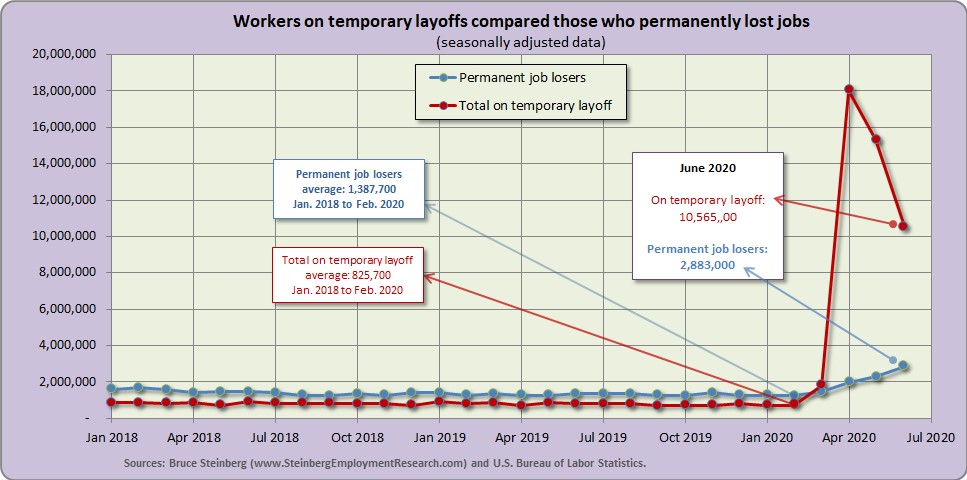

Temporary Layoffs compared to permanent

job losers ...

Now that we have either made the unemployment situation clearer or

completely confused you at this point, let's look at those who

think they are on temporary layoff and those who know that they

have permanently lost their job.

As you can see, more people considered themselves as having

permanently lost their jobs in June from the month prior and fewer considered themselves

on only a temporary layoff.

Specifically, 4,778,000 fewer considered themselves on temporary

layoffs in June from the previous month, probably because they got

called back to work. But, 1,604,000 more consider themselves having

permanently lost their job in June than in February, which was

the month before furloughs

began due to the pandemic.

As we've mentioned before, there is likely a large number of those

who think they are on a temporary layoff but, in reality, have

little chance of being called back because there will be no job or

company to go back to.

|

|

May 2020

(published June 5, 2020)

return to top |

|

Potpourri ...

Last month (see the discussion here), we discussed workers on

self-reported temporary layoffs questioning if "these workers [are]

really only on temporary layoffs? Obviously, returning to work is

contingent on a business to return to -- and many businesses may not

survive and reopen. Are workers accurately reporting their job

prospects or is it wishful thinking that they will be recalled from

layoffs? Also, are employers are not being frank by dangling the

prospect that furloughed workers will be the first to be rehired ...

It is likely that many of the jobs lost will not be coming back

quickly, or even not at all."

The Federal Reserve's Beige Book, which came out last week covering

the period from early April to mid-May (our summation of it

highlighting comments relevant to staffing, IT, and sectors relevant

to them is

here) seems to bear that

supposition out. In addition, the employers who are trying to call

back workers are finding them not willing to come back in some cases

because the extra $600 weekly supplement to regular unemployment

benefits is making it financially beneficial not to return to work,

e.g.: "... overcoming the lure of expanded unemployment benefits."

That weekly supplement expires on July 31. We think it's important

to be reminded that unemployment benefits not only provide

assistance to workers and their families, but enable those who are

out of work to continue to be actively spending consumers, which is

the basis for the economy. Keep in mind that consumer spending is

responsible for about 70 percent of GDP so regardless of political

leanings, the money being distributed to the unemployed regardless